The manager of a computer software company wishes to study the number of hours senior executives by type of industry spend at their desktop computers. The manager selected a sample of five executives from each of three industries. At the .05 significance level, can she conclude there is a difference in the mean number of hours spent per week by industry?

Banking Retail Insurance

12 8 10

10 8 8

10 6 6

12 8 8

10 10 10

Answers

Answer:

Since the calculated value of F= 5.733 falls in the critical region we reject the null hypothesis and conclude all three means are not equal.

Explanation:

The given data is

Banking Retail Insurance

12 8 10

10 8 8

10 6 6

12 8 8

10 10 10

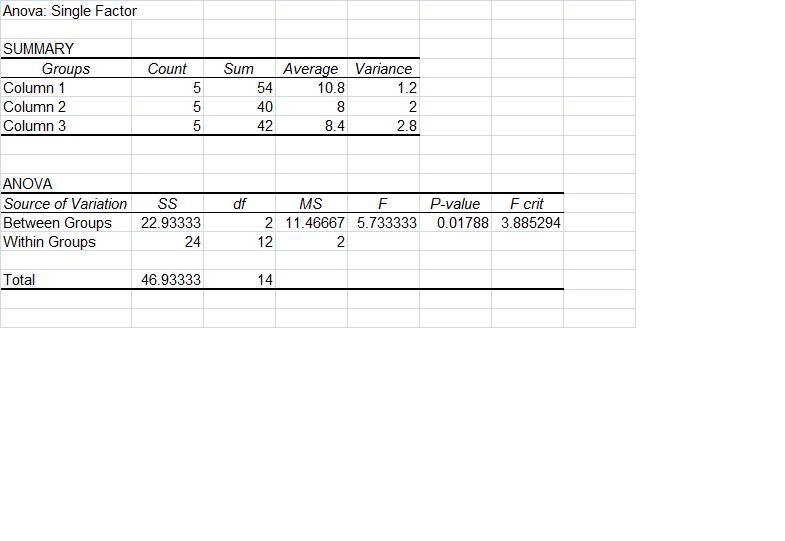

The results of excel are:

Anova: Single Factor

SUMMARY

Groups Count Sum Average Variance

Column 1 5 54 10.8 1.2

Column 2 5 40 8 2

Column 3 5 42 8.4 2.8

1) Let the null and alternate hypotheses be

H0: u1=u2=u3 i.e all the three means are equal and

Ha: Not all three means are equal

2) The significance level is set at ∝ =0.05

3)The test statistic to use is

F= sb²/ sw²

which has F distribution with v1= k-1 →3-1=2 and v2= n-k →15-3=12 degrees of freedom

After calculations the following table is obtained.

ANOVA

Source SS df MS F P-value F crit

of Variation

B/w Groups 22.93 2 11.467 5.733 0.01788 3.885

Within Groups 24 12 2

Total 46.93 14

4) The critical region is F ≥ F(0.05, 2,12) = 3.885

5) Since the calculated value of F= 5.733 falls in the critical region we reject the null hypothesis and conclude all three means are not equal.

Related Questions

Choose the sentence that uses correct punctuation.

A. Data may be illustrated in many forms: tables, bar charts, line charts, pie charts, flowcharts, organizational charts, or photographs.

B. Data may be illustrated in many forms: tables: bar charts: line charts: pie charts: flowcharts: organizational charts: or photographs.

C. When he arrived we began the presentation. When he arrived, we began the presentation. Alex, is not attending, the sales meeting.

D. Alex is not attending the sales meeting.

Answers

Answer: A

Explanation:

"Data may be illustrated in many forms: tables, bar charts, line charts, pie charts, flowcharts, organizational charts, or photographs." uses correct punctuation. Option (a) is correct.

What do you mean by Data?Data are pieces of information that have been converted into a format that can be moved or processed quickly.

Punctuation, also known as interpunction, is the use of white space, traditional signs (also known as punctuation marks), and specific typographical methods to help readers understand and interpret written material correctly, whether they are reading it silently or loudly. "It is the practice, action, or system of adding points or other small marks into texts to facilitate understanding; segmentation of text into phrases, clauses, etc., by means of such marks," is another definition.

Therefore, Option (a) is correct. "Data may be illustrated in many forms: tables, bar charts, line charts, pie charts, flowcharts, organizational charts, or photographs." uses correct punctuation.

Learn more about Data, here;

https://brainly.com/question/10980404

#SPJ5

Gundy Company expects to produce 1,213,200 units of Product XX in 2020. Monthly production is expected to range from 80,000 to 114,000 units. Budgeted variable manufacturing costs per unit are: direct materials $5, direct labor $7, and overhead $11. Budgeted fixed manufacturing costs per unit for depreciation are $6 and for supervision are $1. In March 2020, the company incurs the following costs in producing 97,000 units: direct materials $515,000, direct labor $670,000, and variable overhead $1,073,000. Actual fixed costs were equal to budgeted fixed costs. Prepare a flexible budget report for March. (List variable costs before fixed costs.)

Answers

Answer:

Gundy Company

Flexible Budget Report for March 2020:

Actual Budget Flexible Budget Variance

Direct materials $515,000 $485,000 $30,000 U

Direct labor 670,000 679,000 9,000 F

Variable overhead 1,073,000 1,067,000 6,000 U

Actual fixed costs 679,000 679,000 0 None

Total costs incurred $2,937,000 $2,910,000 $27,000 U

Explanation:

a) Data and Calculations:

Expected production of Product XX in 2020 = 1,213,200 units

Monthly production range = 80,000 to 114,000 units

Budgeted variable manufacturing costs per unit are:

Direct materials $5

Direct labor $7

Overhead $11

Total variable $23

Fixed manufacturing costs per unit:

Depreciation are $6

Supervision are $1

Total fixed costs $7

Total costs = $30

March 2020 costs incurred for 97,000 units:

Direct materials $515,000

Direct labor $670,000

Variable overhead $1,073,000

Actual fixed costs 679,000

Total costs incurred $2,937,000

Flexible Budget Report for March 2020:

Actual Budget Flexible Budget Variance

Direct materials $515,000 $485,000 $30,000 U

Direct labor 670,000 679,000 9,000 F

Variable overhead 1,073,000 1,067,000 6,000 U

Actual fixed costs 679,000 679,000 0 None

Total costs incurred $2,937,000 $2,910,000 $27,000 U

Marigold Corp. and its divisions are engaged solely in manufacturing operations. The following data pertain to the segments in which operations were conducted for the year ended December 31, 2021.

Assets

Industry Revenue Profit 12/31/21

A $8010000 $1315000 $15920000

B 6740000 1122000 13840000

C 5010000 960000 10110000

D 2300000 440000 52100

In its segment information for 2018, how many reportable segments does Marigold have?

a. Three

b. Four

c. Five

d. Six

Answers

Answer: b. Four

Explanation:

A reportable segment needs to satisfy at least one of the following criteria:

Its revenues need to be 10% or more of total revenue.Its profit or less has to be 10% or more of total profit or lossIts assets have to be 10% or more of total combined assetsTotal revenue:

= 8,010,000 + 6,740,000 + 5,010,000 + 2,300,000

= $22,060,000

Total profit:

= 1,315,000 + 1,122,000 + 960,000 + 440,000

= $3,837,000

Total assets

= 15,920,000 + 13,840,000 + 10,110,000 + 5,210,000

= $45,080,000

Industry A proportion of total revenue:

= 8,010,000 / 22,060,000

= 36.3%

Qualifies as reportable segment

Industry B proportion of total revenue:

= 6,740,000 / 22,060,000

= 31%

Qualifies as reportable segment

Industry C proportion of total revenue:

= 5,010,000 / 22,060,000

= 23%

Qualifies as reportable segment

Industry D proportion of total revenue:

= 2,300,000 / 22,060,000

= 10.4%

Qualifies as reportable segment

how to vote correctly? explain your answer

Answers

Thornton Industries began construction of a warehouse on July 1, 2021. The project was completed on March 31, 2022. No new loans were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding throughout the construction period:

$3,000,000, 12% note

$7,000,000, 7% bonds

Construction expenditures incurred were as follows:

July 1, 2021 $ 700,000

September 30, 2021 990,000

November 30, 2021 990,000

January 30, 2022 930,000

The company’s fiscal year-end is December 31.

Required:

Calculate the amount of interest capitalized for 2021 and 2022.

Calculate the amount of interest capitalized for 2021. (Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (i.e. 0.123 should be entered as 12.3%).)

Date Expenditure Weight Average

July 1, 2021 x =

September 30, 2021 x =

November 30, 2021 x =

Accumulated expenditures

Amount Interest Rate Capitalized Interest

Average accumulated expenditures x % x =

2021

Date Expenditure Weight Average

January 1, 2022 x =

January 30, 2022 x =

Amount Interest Rate Capitalized Interest

Average accumulated expenditures x x =

Answers

Solution :

The interest capitalization for 2021

Date Expenditure x Weight = Average

1 July,2021 700,000 6/12 350,000

30 Sept,2021 990,000 3/12 247,500

30 Nov, 2021 990,000 1/12 82,500

Total 2,680,000 680,000

Amount x interest rate = Capitalization interest

Average total expenditure 680,000 8.50% 57,800

The weighted average interest rate

[tex]$=\frac{3,000,000 \times 12\% + 7,000,000 \times 7\%}{3,000,000+7,000,000}$[/tex]

= 8.5 %

Balance as on 1st Jan, 2022 = [tex]$2,680,000+57,800 = 2,737,800$[/tex]

The interest Capitalized for 2022

Date Expenditure x Weight = Average

1 Jan,2022 2,737,800 12/12 2,737,800

30 Jan, 2022 930,000 11/12 852,500

Accumulated 3,667,800 3,590,300

expenditures

Amount x interest rate = Capitalization interest

Average accumulated 3,590,000 8.50% 305,175.5

expenditure

Phelan Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and

wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity

base information, along with the estimated activity-base information, is provided below.

Answers

Answer:

below

Explanation:

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.

Activity Cost Activity Base

Procurement $383,000 Number of purchase orders

Scheduling 211,000 Number of production orders

Materials handling 425,500 Number of moves

Product development 710,900 Number of engineering changes

Production 1,420,000 Machine hours

Number of Purchase Orders Number of Production Orders Number of Moves Number of Engineering Changes Machine Hours Number of Units

Disk drives 4,200 450 1,260 11 2,500 2,100

Tape drives 1,600 125 500 6 8,000 4,200

Wire drives 12,200 800 4,200 20 11,100 2,500

Gloria attended a job interview. The purpose of the interview was to assess how well she performs in a discussion with six other candidates. Which type of interview did Gloria attend?

Gloria attended a [blank] interview.

Answers

Answer:

she attended a job interview.

Explanation:

Answer:

Group

Explanation:

Multiple

If the seller has reason to believe that nonconforming goods will be acceptable to the buyer, this could constitute as an exception to the Perfect Tender Rule. In such instances, upon notification of the seller's intent to promplty cure the nonconformity, the seller must be given a reasonable time within which to cure that nonconformity. This prevents the buyer from canceling the contract, and so in this instance, even if the seller has violated the Perfect Tender Rule, the seller will breach the contract only upon failure to cure after a reasonable amount of time.

A. True

B. False

Answers

Answer:

Perfect Tender Rule

A. True

Explanation:

The Uniform Commercial Code's Article 2 recognizes the legal right of a buyer of goods to demand precise conformity of the goods to the product description in quality, quantity, and delivery manner. Therefore, the buyer may reject goods offered by the seller which do not conform to the earlier product descriptions. This rule is called the Perfect Tender Rule. An exception to this rule will be if the seller has a reason to believe that non-conforming goods will be acceptable to the buyer.

Complete the following sentence.

Today, marketing strategies are generally divided into two sectors: inbound and

Answers

Answer:

Today, marketing strategies are generally divided into two sectors: inbound and

outbound.

Explanation:

Marketing strategies are broadly divided into two. One is inbound marketing strategy, which aims to attract customers, who have already indicated interest in an entity's products and services. They are already out there trying to reach out to the entity in order to satisfy their needs. As a marketing strategy category, it utilizes pull marketing activities to create brand awareness and attract willing new customers, including content, blogs, events, search engine optimization (SEO), and social media marketing. Outbound marketing strategy uses push marketing activities to chase customers. For example, it uses TV, radio, and other media ads, trade shows, cold calling, and cold emails.

Select the correct answer from each drop-down menu.

Jerry's company has launched a new product following the market penetration pricing. What rates would his products have and on what would he

spend a lot on?

Jerry's company has launched a new product following the market penetration pricing. Thus, his products have____

and he is spending a lot on

____the product.

price

First blank:

A.) a high

B.) a low

C.) an above average

Second blank:

A.) packaging

B.) manufacturing

C.) advertising

Answers

Jerry's company has launched a new product following the market penetration pricing. Thus, his products have a low price and he is spending a lot on the advertising product price.

Using a lower price during the initial offering of a new product or service, firms utilize penetration pricing as a marketing approach to draw clients to the new offering.

A new product or service can more easily enter the market and draw clients away from rivals thanks to a reduced price. Pricing for market penetration is based on the principle of initially offering a new product at low rates to attract the attention of as many consumers as possible.

A price penetration strategy seeks to increase market share by luring consumers to test new products in the hopes that they would remain loyal after prices return to normal. An online news site that offers a trial month of a subscription-based service is an example of penetration pricing.

To learn more about penetration pricing refer to:

https://brainly.com/question/13566527

#SPJ1

Grouper Company purchased an electric wax melter on April 30, 2020, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase.

List price of new melter $21,804

Cash paid 13,800

Cost of old melter (5-year life, $966 salvage value) 15,456

Accumulated Depreciation-old melter (straight-line) 8,694

Secondhand fair value of old melter 7,176

Required:

Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance. Sage’s fiscal year ends on December 31, and depreciation has been recorded through December 31, 2020.

Answers

Answer and Explanation:

The journal entries are shown below;

a. the exchange has commercial substance

Depreciation expense (($15,456 - $966) ÷ 5 × 4 ÷ 12 ) $966

To Accumulate depreciation $966

(being depreciation expense is recorded)

New Melter ($13,800 + $7,176) $20,976

accumulated depreciation ($8,694 + $966) $9,660

To loss on sale of melter $1,380

To old melter $15,456

To cash $13,800

(being equipment exchange is recorded)

b. The exchange lacks commercial substance

Depreciation expense (($15,456 - $966) ÷ 5 × 4 ÷ 12 ) $966

To Accumulate depreciation $966

(being current depreciation expense is recorded)

New Melter ($13,800 + $7,176) $20,976

accumulated depreciation ($8,694 + $966) $9,660

To loss on sale of melter $1,380

To old melter $15,456

To cash $13,800

(being equipment exchange is recorded)

Tanner-UNF Corporation acquired as a long-term investment $300 million of 6% bonds, dated July 1, on July 1, 2021. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $250 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $260 million.

Required

1.& 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2018 and interest on December 31, 2018, at the effective (market) rate.

3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2018, balance sheet.

4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2019, for $240 mllion. Prepare the journal entries necessary to record the sale, including updating the fair-value adjustment, recording any reclassification adjustment, and recording the sale.

Answers

Answer:

See the attached excel file for all the journal entries.

Explanation:

1.& 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2018 and interest on December 31, 2018, at the effective (market) rate.

Note: See part 1.& 2. of the attached excel file for the journal entries.

In the part part 1.& 2. of the attached excel file, we have:

Discount on bond investment (Bal. Fig) = Bond face value - Amount paid for the bond = $300 million - $250 million = $50 million

Cash interest received = Bond face value * Bond rate * (1 / 2) = $300 million *6% * 1/2 = $9 million

Interest revenue = Amount paid for the bond * Market interest rate * (1 / 2) = $250 million * 8% * (1/2) = $10 million

3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2018, balance sheet.

Note: See part 3 of the attached excel file for the journal entries.

In the part part 3 of the attached excel file, we have:

Fair value adjustment = Fair value of the bonds - Amount paid for the investment - (Interest revenue - Cash interest received) = $260 million - $250 million - ($10 million - $9 million) = ($260 million - $250 million - $1 million) = $9 million

4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2019, for $240 million. Prepare the journal entries necessary to record the sale, including updating the fair-value adjustment, recording any reclassification adjustment, and recording the sale.

Note: See part 4 of the attached excel file for the journal entries.

In the part part 4 of the attached excel file, we have:

Discount on bond investment = Discount on bond investment as obtained in part 1.& 2 above - (Interest revenue - Cash interest received) = $50 million - ($10 million - $9 million) = $49 million

he following labor standards have been established for a particular product: Standard labor-hours per unit of output 10.1 hours Standard labor rate $ 13.90 per hour The following data pertain to operations concerning the product for the last month: Actual hours worked 7,900 hours Actual total labor cost $ 106,650 Actual output 1,100 units

What is the labor efficiency variance for the month?

a. $47,779 F

b. $47,779 U

c. $43,335 F

d. $44,619 F

Answers

Answer:

d. $44,619 Favorable

Explanation:

Given the above information, labor efficiency variance is computed as;

= (Standard quantity - Actual quantity) × Standard rate

Standard quantity = 10.1 × 1,100 = 11110

Actual quantity = 7,900

Standard rate = $13.9

Then,

Labor efficiency variance =

(11,110 - 7,900) × $13.90

= (3,210) × $13.90

= $44,619 favorable

The following transactions occurred during July:

a. Received $1,090 cash for services provided to a customer during July.

b. Issued common stock for $5,800 cash.

c. Received $940 from a customer in partial payment of his account receivable which arose from sales in June.

d. Provided services to a customer on credit, $565.

e. Borrowed $7,900 from the bank by signing a promissory note.

f. Received $1,440 cash from a customer for services to be performed next year.

Required:

What was the amount of revenue for July?

Answers

Answer:

$1,655

Explanation:

Revenue results from transactions with customers. We recognize revenue when services or goods have been transferred to customers not as when they are paid.

Calculation of Revenue for July :

Transaction a $1,090

Transaction d $565

Total Revenue $1,655

therefore,

The amount of revenue for July is $1,655.

Dallas Company uses a job order costing system. The company's executives estimated that direct labor would be $2,310,000 (210,000 hours at $11/hour) and that factory overhead would be $1,510,000 for the current period. At the end of the period, the records show that there had been 190,000 hours of direct labor and $1,210,000 of actual overhead costs. Using direct labor hours as a base, what was the pre-determined overhead rate?

a. $5.17 per direct labor hour.

b. $7.00 per direct labor hour.

c. $6.42 per direct labor hour.

d. $5.84 per direct labor hour.

e. $6.25 per direct labor hour.

Answers

Answer:

Predetermined manufacturing overhead rate= $7.19 per direct labor hour

Explanation:

Giving the following information:

Estimated direct labor hours= 210,000

Estimated overhead costs= $1,510,000

To calculate the predetermined manufacturing overhead rate we need to use the following formula:

Predetermined manufacturing overhead rate= total estimated overhead costs for the period/ total amount of allocation base

Predetermined manufacturing overhead rate= 1,510,000 / 210,000

Predetermined manufacturing overhead rate= $7.19 per direct labor hour

Biopure is a company that manufactures and markets oxygen therapeutics. Its products are Hemopure for human use and Oxyglobin for animal use. Both have been developed as alternatives to red blood cell transfusions. Which of the following would be part of Biopure's internal environment?

a. approval by the U.S.Food and Drug Administration to allow veterinarians to use Oxyglobin.

b. the global market for the raw materials needed to make Hemopure and Oxyglobin

c. the patented manufacturing process that Biopure uses to produce Hemopure and Oxyglobin

d. a competitor developing a similar product

e. changes in patent law

Answers

Answer: c. the patented manufacturing process that Biopure uses to produce Hemopure and Oxyglobin

Explanation:

The internal environment of a company refers to those actions and activities that have to do with the way the company is running from within the country such as corporate culture and management.

In patenting, the Patent that was received will be company propriety and as no one outside the company can access it, it is part of the internal environment that works to ensure that that the company is ran smoothly.

Acct. Optimistic Likely Activity Variance

ID Description Predecessor Mosta a Pessimistic Time (te) [(b - a)/6]2 Critical 7

(a) (m) (b)

1 Design package None 6 12 24 13 9 x

2 Design product 1 18 19 28 20.33 2.78 x

3 Build package 1 4 7 10 7 1

4 Secure patent 2 21 30 39 30 9 x

5 Build product 2 17 29 47 30 25 x

6 Paint 3,4,5 4 7 12 7.3 1.78 x

7 Test market 6 13 18 19 16 1 x

(m) (b) Time (te) 1 Design package

The Variance for the activity Secure patent equals to:_____.

Answers

Answer thats dificult

Explanation: thats dificult

For what reason might keeping an accounts payable subsidiary ledger be unnecessary for a business? A. if the business is very small B. if the business processes invoices for payment. C. if the business pays only on account D. if the business has more customers then vendors

Answers

Answer:

A. if the business is very small

Explanation:

Subsidiary ledgers are maintained to support the entries in the main ledger. They give more details of the individual items in the main ledger.

They are usually used when a company has large sales volumes to make sure transactions are accurate.

However in small businesses there no need for subsidiary ledger in a small company.

Accounts payable subsidiary ledger shows details of amounts owed to suppliers by a business.

When the business is very small there will be no need for this.

While on vacation, Kyle Kingston, the president and chief executive officer of Remstat, Inc., is called by the CEO of Viokam Corporation, who asks Kingston if Remstat would be interested in buying 25 percent of the outstanding shares of Viokam. Remstat is a billion dollar conglomerate which has contemplated acquiring Viokam for some time. Kingston tells Viokam's CEO that Remstat is not interested. Kingston tells Viokam’s CEO, however, that KKIM, Inc., would be willing to buy the shares of Viokam. Kingston is the 100 percent shareholder of KKIM. Viokam sells the shares to KKIM for $35 million. A year later, KKIM sells the shares for $55 million to a mutual fund company. When Remstat's directors discover KKIM's purchase and sale of the Viokam shares, they bring an action against Kingston on behalf of Remstat. Which of the following is correct?

1. Kingston may be held liable to Remstat because he usurped a corporate opportunity.

2. Kingston may not be held liable to Remstat because he became aware of this opportunity outside the scope of his duties as an officer of Remstat.

3. Kingston may not be held liable to Remstat because he acted within the discretion afforded him under the business judgment rule.

4. Kingston may be held liable to Remstat because he exceeded his authority to act for the corporation.

Answers

Answer: A. Kingston may be held liable to Remstat because he usurped a corporate opportunity.

Explanation:

Based on the information given in the question, the correct option is that Kingston may be held liable to Remstat because he usurped a corporate opportunity.

Usurpation of a corporate opportunity is typically regarded as a form of breach of duty and it arises when a worker in a particular company uses the information that he has for his own personal gain.

In this case, Kingston is the 100 percent shareholder of KKIM and uses the information that he has regarding the sabres to his benefit.

Therefore, the correct option is A.

Kemper Company's balance sheet and income statement are shown below (in millions of dollars). The company and its creditors have agreed upon a voluntary reorganization plan. In this plan, each share of the $5 preferred will be exchanged for one share of $1.00 preferred with a par value of $25 plus one 9% subordinated income debenture with a par value of $75. The $9 preferred issue will be retired with cash. The company's tax rate is 30 percent.

Balance Sheet prior to Reorganization (in millions

Current Assets 400 Current liabilities 350

Net fixed assets 450 Advance payments 20

$5 preferred stock, $100 par value (1,000,000) shares 100

$9 preferred stock, no par, callable at 100 (160,000 shares) 30

Common stock, $0.10 par value (10,000,000) shares 50

Retained earnings 300

Total assets 850 Total claims 850

a. Construct the pro forma balance sheet after reorganization takes place. Show the new preferred at its par value.

b. Construct the pro forma income statement after reorganization takes place. How does the recapitalization affect net income available to common stockholders?

Answers

Answer:

Kemper Company

a. Pro forma Balance Sheet after Reorganization (in millions)

Current Assets 400

Net fixed assets 450

Total assets 850

Current liabilities 350

Advance payments 20

9% subordinated Debenture,

$75 par value (1,000,000) 75

$1 preferred stock, $25 par value

(1,000,000) shares 25

Common stock, $0.10 par value

(10,000,000) shares 50

Retained earnings 300

b. Pro forma Income Statement after Reorganization (in millions)

Retained earnings 300

Income tax 128.6 ($300/(1 - 0.3) - $300)

add $5 preferred dividend 5

$9 preferred dividend 1.44

Less: 9% debenture interest (6.75)

Income before taxes $428.29

Income tax 128.49

Income after taxes $299.80

Preferred dividend 1.00

Retained earnings $298.80

The recapitalization reduces the net income available to common stockholders by $0.2 million.

Explanation:

a) Data and Calculations:

Kemper Company

Balance Sheet prior to Reorganization (in millions

Current Assets 400

Net fixed assets 450

Total assets 850

Current liabilities 350

Advance payments 20

$5 preferred stock, $100 par value

(1,000,000) shares 100

$9 preferred stock, no par,

callable at 100 (160,000 shares) 30

Common stock, $0.10 par value

(10,000,000) shares 50

Retained earnings 300

Total assets 850 Total claims 850

Transaction Analysis:

$5 preferred stock, $100 par value (1,000,000) shares $100 $1 Preferred stock, $25 par value (1,000,000) shares $25 9% subordinated Debenture, $75 par value (1,000,000) $75

$9 preferred stock, no par, callable at 100 (160,000 shares) 30 Cash $30

Total assets 850 Total claims 850

Speedy has net income of $30,955, and assets at the beginning of the year of $212,000. Assets at the end of the year total $258,000. Compute its return on assets.

Answers

Answer:

13.17%

Explanation:

Given that;

Net income = $30,955

Asset at the beginning of the year = $212,000

Asset at the end of the year = $258,000

Return on assets = Net income / Average total assets

But,

Average total assets = (Assets at the beginning of the year + Assets at the end of the year ) / 2

Average total assets = ($212,000 + $258,000) / 2

Average total assets = $235,000

Therefore,

Return on assets = ($30,955 / $235,000) × 100

Return on assets = 13.17%

On January 1, Year 1, Missouri Company purchased a truck that cost $56,000. The truck had an expected useful life of 10 years and a $5,000 salvage value. The amount of depreciation expense recognized in Year 2 assuming that Missouri uses the double declining-balance method is:__________

Answers

Answer:

Annual depreciation= $8,160

Explanation:

Giving the following information:

Purchase price= $56,000

Useful life= 10 years

Salvage value= $5,000

To calculate the annual depreciation, we need to use the following formula:

Annual depreciation= 2*[(book value)/estimated life (years)]

Year 1:

Annual depreciation= 2*[(56,000 - 5,000) / 10]

Annual depreciation= $10,200

Year 2:

Annual depreciation= 2*[(51,000 - 10,200) / 10]

Annual depreciation= $8,160

In the trade-off theory, debt levels chosen to balance interest tax shield against the costs of financial distress imply:________

a. an interior optimum (firm value maximizing) debt ratio

b. that investors are irrational, since they require lower returns the hgher the risk

c. that a firm would use little to no debt

d. that a firm would borrow as much as possible

Answers

Answer:

a) an interior optimum (firm value maximizing) debt ratio

Explanation:

Trade off Theory is about capital structure of an economic unit. It mentions about the benefit of debt - ie tax saving, as interest on debt is tax deductible; & cost of debt - bankruptcy & insolvency risk, due to fix interest cost.

The theory depicts the debt level, which is best to - balance interest tax shield against the costs of financial distress imply, which implies that it seeks a balance between benefit & cost of debt.

So, the theory finds the best interior optimum (firm value maximising) debt equity ratio.

On September 30, 2018, Corso Steel acquired a patent from Thermo Steel. The agreement specified that Corso will pay Thermo $1,000,000 immediately and then another $1,000,000 on September 30, 2020. An interest rate of 8% reflects the time value of money for this type of loan agreement.

What amount of interest expense, if any, would Corso record on December 31, 2019, the company’s fiscal year end?

a. $68,687.

b. $80,000.

c. $60,000.

d. $69,959.

Answers

Answer: $69,959

Explanation:

The amount of interest expense, that Corso will record on December 31, 2019, the company’s fiscal year end will be calculated thus:

First, we calculate the present value of payment which will be made on September 30,2020 and this will be:

= $1000000 × 0.857339

= $857339

Then, the interest expense on December 31,2018 will be:

= $857339 × 8%/12 × 3

= $17147

Therefore, the Interest expense on December 31,2019 will be:

= ($857339 + $17147) × 8%

= $874486 × 0.08

= $69959

On January 1, 2018, Splash City issues $340,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $373,648.

Required:

1. Complete the first three rows of an amortization table.

Date Cash Paid Interest Expense Decrease in Carrying Value Carrying Value

1/1/18

6/30/18

12/31/18

On January 1, 2018, Splash City issues $340,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $373,648.

2. Record the bond issue on January 1, 2018, and the first two semiannual interest payments on June 30, 2018, and December 31, 2018.

Answers

Answer:

Splash City

1. 1. The first three rows of an amortization table.

Date Cash Paid Interest Expense Decrease in Carrying Value

Carrying Value

1/1/18 $0 $373,648

6/30/18 $15,300 $14,946 $354 373,294

12/31/18 $15,300 14,932 368 372,926

2. Journal Entries:

January 1, 2018L:

Debit Cash $373,648

Credit 9% Bonds Payable $340,000

Credit Bonds Premium $33,648

To record the proceeds from the bond issue, including the premium.

June 30, 2018:

Debit Interest Expense $14,946

Debit Amortization of Bonds Premium $354

Credit Cash $15,300

To record the first semiannual interest payment.

December 31, 2018:

Debit Interest Expense $14,932

Debit Amortization of Bonds Premium $368

Credit Cash $15,300

To record the second semiannual interest payment.

Explanation:

a) Data and Calculations:

January 1, 2018:

Face value of 9% bonds issued = $340,000

Proceeds from issue of bonds = 373,648

Premium on issue of bonds = $33,648

Coupon Interest rate = 9%

Payment = Semiannually on June 30 and December 31

Market interest rate = 8%

June 30:

Interest expense = $14,946 ($373,648 * 4%)

Cash payment = 15,300 ($340,000 * 4.5%)

Amortized premium $354

Fair value of bonds = $373,294 ($373,648 - $354)

December 31:

Interest expense = $14,932 ($373,294 * 4%)

Cash payment = 15,300 ($340,000 * 4.5%)

Amortized premium $368

Fair value of bonds = $372,926 ($373,294 - $368)

A good is non-rivalrous if:____.

A. It is not possible to prevent an individual from using the good.

B. Those who are unwilling or unable to pay for the good do not obtain its benefits.

C. The quantity of the good is affected by the price a consumer pays for the good.

D. One person's benefit from the good does not reduce the benefit available to other people.

Answers

Answer:

D. One person's benefit from the good does not reduce the benefit available to other people.

Explanation:

A product (good) can be defined as any physical object or material that typically satisfy and meets the demands, needs or wants of customers. Some examples of a product are mobile phones, television, microphone, microwave oven, bread, pencil, freezer, beverages, soft drinks etc.

According to the economist Philip Kotler in his book titled "Marketing management" he stated that, there are five (5) levels of a product. This includes;

1. Core benefit.

2. Generic product.

3. Expected product.

4. Augmented product.

5. Potential product.

The core benefit of a product can be defined as the basic (fundamental) wants or needs that is being satisfied, met and taken care of when a customer purchase a product.

A non-rivalrous product (good) is one in which a person's (buyer's) benefit from through the purchase of a good does not reduce or annul the benefit available to other people.

Aztec Company sells its product for $160 per unit. Its actual and budgeted sales follow

Units Dollars

April (actual) 4,500 720,000

May (actual) 2,200 352,000

June (budgeted) 5,000 800,000

July (budgeted) 4,000 799,000

August (budgeted) 3,000 600,000

All sales are on credit. Recent experience shows that 28% of credit sales are collected in the month of the sale, 42% in the month after the sale, 27% in the second month after the sale, and 3% prove to be uncollectible. The product's purchase price is $110 per unit, 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. The company has the policy to maintain an ending monthly inventory of 18% of the next month's unit sales plus a safety stock of 180 units. The April 30 and May 31 actual Inventory levels are consistent with this policy. Selling and administrative expenses for the year are $1,584,000 and are paid evenly throughout the year In cash. The company's minimum cash balance at the month-end is $120,000. This minimum is maintained, If necessary, by borrowing cash from the bank. If the balance exceeds $120,000, the company repays as much of the loan as It can without going below the minimum. This type of loan carries an annual 13% interest rate. On May 31, the loan balance is $39,500, and the company's cash balance Is $120,000

Required:

a. Prepare a schedule that shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of June and July.

b. Prepare a schedule that shows the computation of budgeted ending inventories (in units) for April, May, June, and July.

c. Prepare the merchandise purchases budget for May, June, and July. Report calculations in units and then show the dollar amount of purchases for each month.

d. Prepare a schedule showing the computation of cash payments for product purchases for June and July.

e. Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month.

Answers

Answer:

a. Total cash collections are as follows:

June = $605,760

July = $715,580

b. Ending units are as follows:

April = 623 units

May = 1,295 units

June = 1,055 units

July = 815 units

c-1. Units purchased are as follows:

May = 2,872 units

June = 4,760 units

July = 2,130 units

c-2. Purchases amount are as follows:

May = $315,920

June = $523,600

July = $234,300

d. Cash payments for product purchases are as follows:

June = $440,528

July = $350,020

e. Loan Balance End of Month are as follows:

June = $1,324,163

July = $2,226,541

Explanation:

Note: See the attached excel file for requirements a, b, c, d, and e.

In the attached excel file under requirement e, the following calculations is made:

June additional loan = Minimum required cash balance - June Preliminary cash balance = $110,000 - (-$1,169,663) = $110,000 + $1,169,663 = $1,279,663

July additional loan = Minimum required cash balance - July Preliminary cash balance = $110,000 - (-$792,378) = $110,000 + $792,378 = $902,378

The financial statements for Highland Corporation included the following selected information:

Common stock $ 1,000,000

Retained earnings $ 770,000

Net income $ 1,020,000

Shares issued 100,000

Shares outstanding 77,000

Dividends declared and paid $ 690,000

The common stock was sold at a price of $31 per share.

1. What is the amount o f additional paid-in capital?

2. What was the amount of retained earnings at the beginning of the year?

3. How many shares are in treasury stock?

Answers

Answer:

Highland Corporation

1. The amount of additional paid-in capital is:

= $210,000.

2. The amount of the retained earnings at the beginning of the year is:

= $440,000.

3. The number of shares in treasury stock is:

= 23,000 shares.

Explanation:

a) Data and Calculations:

Common stock $ 1,000,000

Retained earnings $ 770,000

Net income $ 1,020,000

Shares issued 100,000

Shares outstanding 77,000

Dividends declared and paid $ 690,000

Price of common stock = $31 per share

1. The amount of additional paid-in capital is:

Issued stock = 100,000 * ($31 - $10) = $210,000

2. The amount of the retained earnings at the beginning of the year:

Retained earnings at the ending $ 770,000

Add dividend 690,000

Total available for distribution $1,460,000

Less Net income 1,020,000

Retained earnings at the beginning $440,000

3. Treasury stock = 23,000 (100,000 - 77,000)

Winslow Company expects sales of its financial calculators to be $192,000 in the first quarter and $248,000 in the second quarter. Its variable overhead is approximately 15 percent of sales, and fixed overhead costs are $49,000 per quarter.

Required:

Compute Winslow's manufacturing overhead budget for the first two quarters.

Answers

Answer:

Budgeted manufacturing overhead for 1st Quarter = [$192,000*15%] + $49,000

= $28,800 + $49,000

= $77,800

Budgeted manufacturing overhead for 2nd Quarter = [$248,000*15%] + $49,000

= $37,200 + $49,000

= $86,200

Ivanhoe Co. purchases land and constructs a service station and car wash for a total of $465000. At January 2, 2021, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $500000 and immediately leased from the oil company by Ivanhoe. Fair value of the land at time of the sale was $45000. The lease is a 10-year, noncancelable lease. Ivanhoe uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Ivanhoe at termination of the lease. A partial amortization schedule for this lease is as follow:

Payments Interest Amortization Balance

Jan 2 2018 510000.00

Dec. 31, 2018 $83000.15 $51000.00 $32000. 47 7999.85

Dec. 31, 2019 83000.15 47799.99 35200. 44 2799.69

Dec. 31, 2020 83000.15 44279.97 38720.18 40 4079.51

The total lease-related expenses recognized by the lessee during 2021 is:_________

Answers

Answer:

$80,833.32

Explanation:

Correct date "Jan 2 2019 510000.00

Dec. 31, 2019 $83000.15 $51000.00 $32000. 47 7999.85

Dec. 31, 2021 83000.15 47799.99 35200. 44 2799.69

Dec. 31, 2022 83000.15 44279.97 38720.18 40 4079.51"

Computation of Lease related Expense Recognized by lessee in 2019

Depreciation Expense = (Total cost - Salvage value) / Estimated life

Depreciation Expense = $500,000 - $45,000 / 15

Depreciation Expense = $33,033.33

Interest Expense = $47,799.99

Total lease-related expenses = Depreciation Expense + Interest Expense

Total lease-related expenses = $33,033.33 + $47,799.99

Total lease-related expenses = $80,833.32