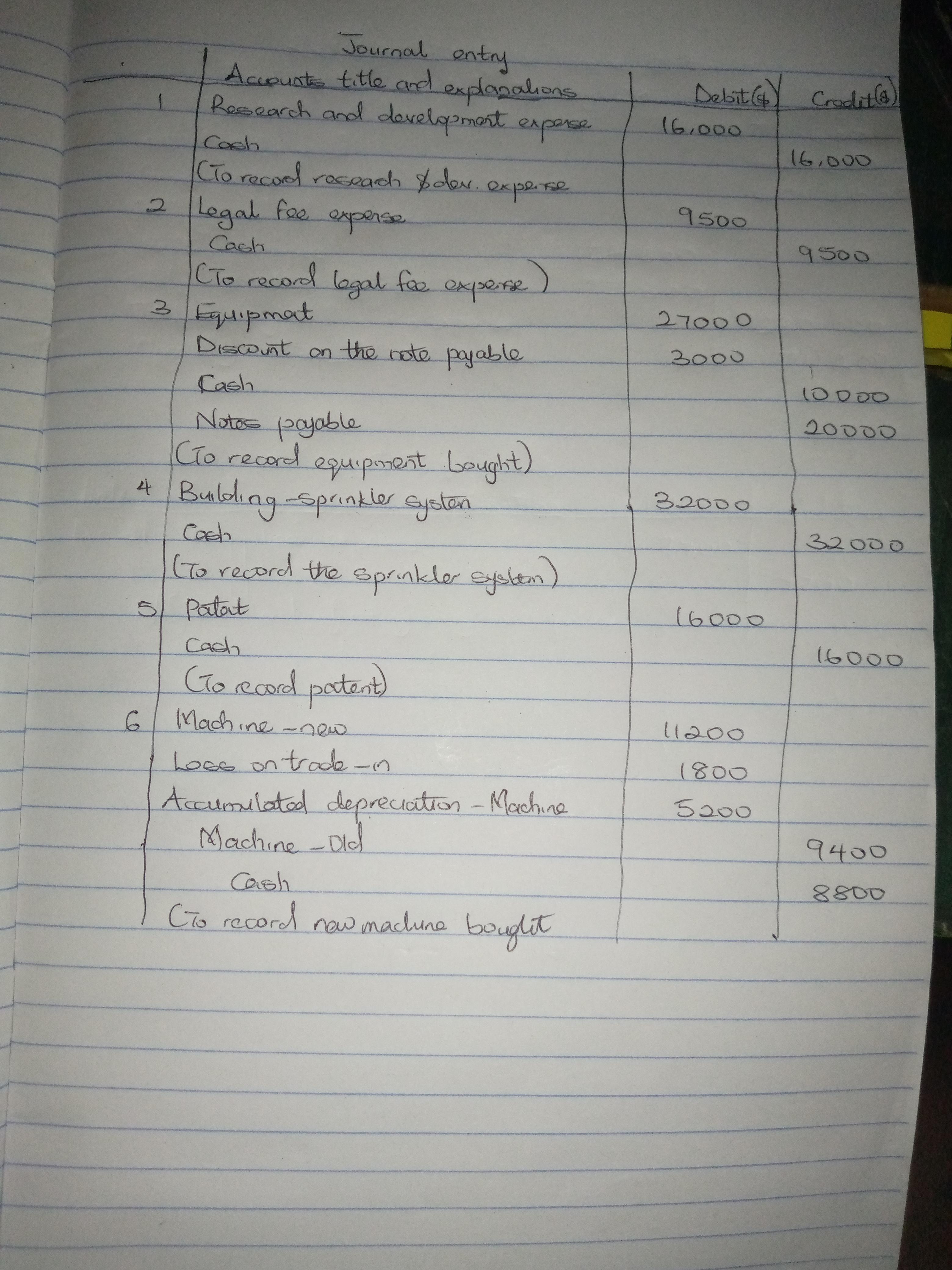

Consider each of the transactions below. All of the expenditures were made in cash.

a. The Edison Company spent $16,000 during the year for experimental purposes in connection with the development of a new product.

b. In April, the Marshall Company lost a patent infringement suit and paid the plaintiff $9,500.

c. In March, the Cleanway Laundromat bought equipment. Cleanway paid $10,000 down and signed a noninterest-bearing note requiring the payment of $20,000 in nine months. The cash price for this equipment was $27,000.

d. On June 1, the Jamsen Corporation installed a sprinkler system throughout the building at a cost of $32,000.

e. The Mayer Company, plaintiff, paid $16,000 in legal fees in November, in connection with a successful infringement suit on its patent.

f. The Johnson Company traded its old equipment for new equipment. The new equipment has a fair value of $11,200. The old equipment had an original cost of $9,400 and a book value of $4,200 at the time of the trade. Johnson also paid cash of $8,800 as part of the trade. The exchange has commercial substance.

Required:

Prepare journal entries to record each of the above transactions.

Answers

Answer: See attachment

Explanation:

The journals entry shows the transactions that Edison Company has undertaken. The transactions are shows both the debit and credit balances.

The attachments for the question have been attached for further analysis.

Related Questions

According to the video, what are some things that Human Resources Managers do? Check all that apply.

oversee hiring and firing

purchase computers

distribute office supplies

develop training programs

develop personnel policies

develop pricing strategies

develop recruiting programs

Answers

Answer:

1 4 5 7

Explaination:

Answer:

1 4 5 7

Explanation:

Cost of Goods Sold and Income Statement Schuch Company presents you with the following account balances taken from its December 31 adjusted trial balance:

Inventory, January 1 $40,000 Purchases returns $3,500

Selling expenses 35,000 Interest expense 4,000

Purchases 110,000 Sales discounts taken 2,000

Sales 280,000 Gain on sale of property (pretax) 7,000

General and administrative expenses 22,000 Freight-in 5,000

Additional data:

1. A physical count reveals an ending-inventory of $22,500 on December 31.

2. Twenty-five thousand shares of common stock have been outstanding the entire year.

3. The income tax rate is 30% on all items of income.

Required:

a. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Schuch's cost of goods sold.

b. Prepare a 2013 multiple-step income statement.

c. Prepare a 2013 single-step income statement.

Answers

Answer:

Schuch Company

a) Schedule of Cost of Goods Sold

Inventory, January 1 $40,000

Purchases 110,000

Purchases returns -3,500

Freight-in 5,000

Cost of goods available for sale $151,500

less Inventory, December 31 22,500

Cost of goods sold $129,000

b) Multi-step Income Statement

For the year ended December 31, 2013:

Net Sales Revenue $278,000

Cost of Goods Sold 129,000

Gross profit $149,000

Expenses:

Selling expenses 35,000

General & admin exp. 22,000 57,000

Operating profit $92,000

Interest expense 4,000

Income after interest expense $88,000

Gain on sale of property (pretax) 7,000

Comprehensive income before tax $95,000

Income Tax (30%) 28,500

Net income $66,500

EPS = $2.66

c) Single-step Income Statement

For the year ended December 31, 2013:

Net Sales Revenue $278,000

Gain on sale of property (pretax) 7,000

Total revenue and gains $285,000

Cost of Goods Sold 129,000

Selling expenses 35,000

General & admin exp. 22,000

Interest expense 4,000

Total expenses $190,000

Income before taxes $95,000

Income Taxes (30%) 28,500

Net income $66,500

EPS = $2.66

Explanation:

a) Data and Calculations:

December 31 adjusted trial balance:

Inventory, January 1 $40,000

Purchases returns $3,500

Selling expenses 35,000

Interest expense 4,000

Purchases 110,000

Sales discounts taken 2,000

Sales 280,000

Gain on sale of property (pretax) 7,000

General and administrative expenses 22,000

Freight-in 5,000

Additional data:

Ending Inventory $22,500

Common Stock outstanding = 25,000

Income tax rate = 30%

Sales $ 280,000

Sales discounts taken 2,000

Net Sales Revenue $278,000

The text presents five signs of organizational culture: mission statement, stories & language, physical layout, rules & policies, and rituals. Select an organization where you have worked or are familiar with and identify an example of each sign of organizational culture. How do you think each of these things conveyed the organizational culture to employees and customers/clients.

Answers

Answer:

Face book

mission statement: give people the power to build community and bring the world closer together.

physical layout: How Face book is constructed.

rules & policies: The employees are required to act honestly, lawfully, ethically and in favor of the company they represent.

rituals: Face book looks for innovation and breaking the status quo, and to do so Face book employees are invited to paint, create and decore their offices and public spaces with own made art.

Explanation:

Organizational culture is what we call the mix of core values and actions that make up an organization, it's mostly and widely used for companies but it also applies to schools, governments, non-profits, and any group of people working together towards a goal.

The mission statement is basically what the organization wants to achieve, or its dreamed goal.

Stories and language are the speech that the organization communicates to the audience or anyone interacting with it.

The physical layouts are the colors and buildings, apps, or any way of direct interaction that any person could have with the organization.

Rules and policies are what dictate the behavior of all the employees and people related to the organization.

And rituals are the activities that the organization does in order to reinforce the values and policies they try to live day by day, doing your own painting is one example of these rituals.

Hart Attorney at Law experienced the follwoing transactions in 2016, the first year of operations:

1. Accepted $36,000 on 4/1/16, as a retainer for services to be performed evenly over the next 12 months.

2. Performed legal services for cash of $54,000.

3. Purchased $2,800 of office suppies on account.

4. Paid $2,400 of the amount due on accounts payable.

5. Paid a cahs dividend to the stockholders of $5,000.

6. Paid cash for operationg expenses of $31,000.

7. Determined that at the end of the accounting period $200 of office supplies remained on hand.

8. On 12/31/16, recognized the revenue that had been earned for services performed in accordance with Transaction 1

Required:

Show the effects of the events on the fianncial statements using a horizontal statement model.

Answers

Answer:

I used an excel spreadsheet since there is not enough room here.

Explanation:

Last month Empire Company had a $35,280 profit on sales of $287,000. Fixed costs are $68,040 a month. By how much would sales be able to decrease for Empire to still break even

Answers

Answer:

sales might decrease by $287,000 - $189,000 = $98,000 and the company will still break even

Explanation:

gross profit = net income + fixed costs = $35,280 + $68,040 = $103,320

COGS = total sales - gross profit = $287,000 - $103,320 = $183,680

contribution margin ratio = $103,320 / $287,000 = 36%

break even point in $ = $68,040 / 36% = $189,000

sales might decrease by $287,000 - $189,000 = $98,000 and the company will still break even

What is a sum of money that is borrowed and is expected to be paid back with interest?

Answers

Explanation: when someone borrows money from someone else or even from the bank it is done on the condition that the money would eventually be paid back in a certain period of time with an interest payment

A check register shows a balance of $152.34. The bank statement shows that a check for $75.00 deposited by the account owner was drawn against insufficient funds and was returned. A charge for $2.00 was also deducted by the bank because of the return. Compute the adjusted cash balance of the check register.

Answers

Answer:

$150.34

Explanation:

The $75 check has been drawn against insufficient funds and has been returned so this check won't be included in the adjusted cash balance of the check register.

A charge for $2.0 will be deducted from the balance shown by the cash register above to calculate the adjusted cash balance of the check register.

Adjusted cash balance of the check register = $152.34 - $2

Adjusted cash balance of the check register = $150.34

A common step in the testing for accounts payable is to test subsequent disbursements for improper/proper inclusion/exclusion in year-end accounts payable CONCEPT REVIEW A common way to test accounts payable is to examine the check register after period end and make selections for testing. Items are selected and then examined for detail. A determination is then made to conclude whether the amount should have been a liability as of year-end and, if so, if it was recorded as such

1. When searching for unrecorded liabilities, the auditors consider transactions recorded__________year end.

2. Accounts payable __________can be mailed to vendors from whom substantial purchases have been made.

3. To gain overall assurance as to the reasonableness of accounts payable, the auditor may consider _________.

4. When auditors find unrecorded liabilities, before adjusting they must consider __________.

5 Auditiors need to consider_______ terms for determining ownership and whether a liability should be recorded.

Answers

Answer:

1. When searching for unrecorded liabilities, the auditors consider transactions recorded after year end.

Auditors consider transactions recorded after year end to determine if it was supposed to be recorded in the current period.

2. Accounts payable confirmation can be mailed to vendors from whom substantial purchases have been made.

As a way to keep a document trail, creditors from whom substantial goods were bought from can be mailed a confirmation.

3. To gain overall assurance as to the reasonableness of accounts payable, the auditor may consider ratios.

Ratios such as the Payables turnover can be used to evaluate the reasonableness of Accounts payable.

4. When auditors find unrecorded liabilities, before adjusting they must consider materiality.

They must consider if the adjustment is material or significant enough to record.

5 Auditiors need to consider shipping terms terms for determining ownership and whether a liability should be recorded.

Shipping terms need to be considered because they can tell who owns goods in transit and therefore if a liability is needed for them. Shipping terms such as FOB Shipping point mean that the business incurs the liability as soon as the seller ships the goods.

On December 31, 2021, the end of the fiscal year, California Microtech Corporation completed the sale of its semiconductor business for $15 million. The semiconductor business segment qualifies as a component of the entity according to GAAP. The book value of the assets of the segment was $13 million. The loss from operations of the segment during 2021 was $4.8 million. Pretax income from continuing operations for the year totaled $7.8 million. The income tax rate is 25%.

Prepare the lower portion of the 2021 income statement beginning with income from continuing operations before income taxes. Ignore EPS disclosures. (Amounts to be deducted and negative amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions.)

Answers

Answer and Explanation:

The preparation of the lower portion is presented below:

Income from the continuing operation

before income tax $7,800,000

Less: Income tax expenses ($7,800,000 × 25%) (1,950,000)

Income from continuing operation(A) 5,850,000

Discontinued operation:

Loss from operation discontinued components

($15 - $13 - $4.8) ($2,800,000)

Income tax benefits ($2,800,000 × 25%) $700,000

Loss on discontinued operation(B) ($21,000,000)

Net loss (A - B) -$15,150,000

Determine the selling price PV, per $1,000 maturity value, of the bond. HINT [See Example 8.] (Assume twice-yearly interest payments. Do not round those payments to the nearest cent. Round your selling price PV to the nearest cent.) 20-year, 4.225% bond, with a yield of 4.23%

Answers

Answer:

$999.60

Explanation:

For computing the selling price i.e. present value we have to use the present value function i.e. shown below:

Given that

NPER = 20 × 2 = 40

PMT = $1,000 × 4.225% ÷ 2 = $21.125

RATE = 4.23% ÷ 2 = 2.115%

FV = $1,000

the formula is shown below:

PV =-PV(RATE;NPER;PMTFV;TYPE)

After applying the above formula, the present value is $999.60

In its first year of business, Borden Corporation had sales of $2,020,000 and cost of goods sold of $1,210,000. Borden expects returns in the following year to equal 6% of sales. The adjusting entry or entries to record the expected sales returns is (are):

Answers

Answer: Please see answers in explanation column

Explanation:

Accounts title and explanation Debit Credit

Sales returns and allowances $121,200

Sales refund payable $121,200

Calculation

Expected Sales returns and allowances = sales x expected percentage

= 2,020,000 x 6%= $121,200

Accounts title and explanation Debit Credit

Inventory returns estimated $72,600

Cost of goods sold $72,600

Calculation

expected Cost of goods sold = Cost of goods soldx expected percentage

= 1,210,000 x6%=$72,600

Cooperative San José of southern Sonora state in Mexico makes a unique syrup using cane sugar and local herbs. The syrup is sold in small bottles and is prized as a flavoring for drinks and for use in desserts. The bottles are sold for $12 each. The first stage in the production process is carried out in the Mixing Department, which removes foreign matter from the raw materials and mixes them in the proper proportions in large vats. The company uses the weighted-average method in its process costing system.

A hastily prepared report for the Mixing Department for April appears below:

Units to be accounted for:

Work in process, April 1 (materials 90% complete; conversion 80% complete) 5,700

Started into production 34,100

Total units to be accounted for 39,800

Units accounted for as follows:

Transferred to next department 29,400

Work in process, April 30 (materials 70% complete; conversion 50% complete) 10,400

Total units accounted for 39,800

Cost Reconciliation Cost to be accounted for:

Work in process, April 1 $15,276

Cost added during the month 96,248

Total cost to be accounted for $111,524

Cost accounted for as follows:

Work in process, April 30 $20,384

Transferred to next department 91,140

Total cost accounted for $111,524

Required:

a. What were the Mixing Department's equivalent units of production for materials and conversion for April?

b. What were the Mixing Department's cost per equivalent unit for materials and conversion for April? The beginning inventory consisted of the following costs: materials, $10,545; and conversion cost, $4,731. The costs added during the month consisted of: materials, $64,649; and conversion cost, $31,599.

c. How many of the units transferred out of the Mixing Department in April were started and completed during that month?

d. The manager of the Mixing Department stated, "Materials prices jumped from about $1.65 per unit in March to $2.15 per unit in April, but due to good cost control I was able to hold our materials cost to less than $2.15 per unit for the month." Should this manager be rewarded for good cost control?

Answers

Answer:

a. EU:

materials = 29,400 + 7,280 = 36,680

conversion = 29,400 + 5,200 = 34,600

b. cost per EU:

materials = $75,194 / 36,680 = $2.05

conversion = $36,330 / 34,600 = $1.05

c. units started and completed during April = 23,700

d. no, he didn't do anything, When a company uses the weighted average process costing method, the cost of beginning WIP is used to determine the cost per equivalent unit. On the other hand, FIFO process costing method doesn't, it only considers costs incurred during the month to calculate cost per equivalent unit.

Explanation:

beginning WIP 5,700 $15,276

materials, $10,545

conversion cost, $4,731

units started 34,100

costs added during the month = $96,248

materials, $64,649

conversion cost, $31,599

units transferred out 29,400 $91,140

ending WIP 10,400 $20,384

materials 70% = 7,280 EU

conversion 50% = 5,200 EU

EU:

materials = 29,400 + 7,280 = 36,680

conversion = 29,400 + 5,200 = 34,600

total cost for materials = $64,649 + $10,545 = $75,194

total cost for conversion = $31,599 + $4,731 = $36,330

cost per EU:

materials = $75,194 / 36,680 = $2.05

conversion = $36,330 / 34,600 = $1.05

units started and completed during April = 29,400 - 5,700 = 23,700

Major League Bat Company manufactures baseball bats. In addition to its work in process inventories, the company maintains inventories of raw materials and finished goods. It uses raw materials as direct materials in production and as indirect materials. Its factory payroll costs include direct labor for production and indirect labor. All materials are added at the beginning of the process, and conversion costs are applied uniformly throughout the production process. Required: You are to maintain records and produce measures of inventories to reflect the July events of this company. The June 30 balances: Raw Materials Inventory, $22,000; Work in Process Inventory, $9,690 ($2,810 of direct materials and $6,880 of conversion); Finished Goods Inventory, $140,000; Sales, $0; Cost of Goods Sold, $0; Factory Payroll Payable, $0; and Factory Overhead, $0. 1. Prepare journal entries to record the following July transactions and events. Purchased raw materials for $130,000 cash (the company uses a perpetual inventory system). Used raw materials as follows: direct materials, $52,540; and indirect materials, $11,500. Recorded factory payroll payable costs as follows: direct labor, $206,000; and indirect labor, $26,500. Paid factory payroll cost of $232,500 with cash (ignore taxes). Incurred additional factory overhead costs of $83,000 paid in cash. Allocated factory overhead to production at 50% of direct labor costs. 2. Information about the July inventories follows. Use this information with that from part 1 to prepare a process cost summary, assuming the weighted-average method is used. (Round "Cost per EUP" to 2 decimal places.) Units Beginning inventory 6,500 units Started 14,000 units Ending inventory 8,000 units Beginning inventory Materials—Percent complete 100 % Conversion—Percent complete 80 % Ending inventory Materials—Percent complete 100 % Conversion—Percent complete 30 % 3.

Using the results from part 2 and the available information, make computations and prepare journal entries to record the following: Total costs transferred to finished goods for July. Sale of finished goods costing $273,200 for $640,000 in cash.Using the results from part 2 and the available information, make computations and prepare journal entries to record the following: Total costs transferred to finished goods for July. Sale of finished goods costing $273,200 for $640,000 in cash. Using the results from part 2 and the available information, make computations and prepare journal entries to record the following: Total costs transferred to finished goods for July. Sale of finished goods costing $273,200 for $640,000 in cash.

Answers

Answer:

Major League Bat Company

1. Journal Entries:

a. Debit Raw Materials Inventory $130,000

Credit Cash Account $130,000

To record the purchase of raw materials.

b. Debit Work in Process $52,540

Debit Manufacturing Overhead $11,500

Credit Raw Materials $64,040

To record materials used.

c. Debit Factory Wages $232,500

Credit Cash Account $232,500

To record factory payroll paid in cash.

d. Debit Work in Process $206,000

Debit Manufacturing Overhead $26,500

Credit Factory Wages $232,500

To record factory payroll costs.

e. Debit Manufacturing Overhead $83,000

Credit Cash Account $83,000

To record additional factory overhead costs.

f. Debit Work In Process $103,000

Credit Manufacturing Overhead $103,000

To allocate factory overhead to production at 50% of direct labor costs.

2. Computation of Equivalent Units of Production:

Materials Conversion Total

Beginning inventory 6,500 units 6,500 5,200

Started 14,000 units 14,000 14,000

Ending inventory 8,000 units 8,000 2,400

Total equivalent unit 22,000 16,400

3. Costs of Production:

Beginning Inventory $2,810 $6,880

Raw materials 52,540 309,000

Total costs $55,350 $315,880

Total equivalent unit 22,000 16,400

Cost per equivalent unit $2.52 $19.26

Total costs:

Started 14,000 $35,280 14,000 $269,640 $304,920

Ending inventory 8,000 20,160 2,400 46,224 $66,384

Total 22,000 $55,440 16,400 $315,864 $371,304

4. Journal Entries:

Debit Finished Goods Inventory $304,920

Credit Work In Process $ 304,920

To record the transfer of goods.

Debit Cost of Goods Sold $273,200

Credit Finished Goods Inventory $273,200

To record the cost of goods sold.

Debit Cash Account $640,000

Credit Sales Revenue $640,000

To record the sale of goods for cash.

5. Ledger accounts:

Raw Materials Inventory

Accounts Titles Debit Credit

Balance $22,000

Cash Account 130,000

Work in Process $52,540

Manufacturing Overhead 11,500

Work In Process

Accounts Titles Debit Credit

Balance $9,690

Raw materials 52,540

Factory Wages 206,000

Manufacturing

Overhead 103,000

Finished Goods Inventory $ 304,920

Balance 66,384

Manufacturing Overhead

Accounts Titles Debit Credit

Raw materials $11,500

Factory wages 26,500

Other overheads 83,000

Work in Process applied $103,000

Underapplied overhead 18,000

6. Income Statement:

For July

Sales Revenue $640,000

Cost of goods sold 273,200

Underapplied overhead 18,000 $291,200

Gross profit $348,800

Explanation:

a) Data and Calculations:

June 30 Balances:

Raw Materials Inventory, $22,000;

Work in Process Inventory, $9,690 ($2,810 of direct materials and $6,880 of conversion);

Finished Goods Inventory, $140,000;

Sales, $0;

Cost of Goods Sold, $0;

Factory Payroll Payable, $0; and

Factory Overhead, $0. 1.

Maria Boyd has been hired by Barnum Hotels to manage staffing for the regional hotel chain. Barnum intends to open two new hotels within the next three years and will have many job positions to fill. Historically, employee turnover is high at Barnum as employees remain with the company for one or two years before quitting. Maria realizes that Barnum needs to make significant changes in its personnel strategy in order to meet the company's goals for the future and improve employee retention rates. All of the following questions are relevant to Mari's decision to fill top positions at the new hotels with internal candidates EXCEPT::_______

a. What are the key managerial positions that are available at the new hotels?

b. What percentage of employers in the service industry use succession planning?

c. What skills, education, and training have been provided to potential candidates?

d. What is the designated procedure for assessing and selecting potential candidates?

Answers

Answer:

b. What percentage of employers in the service industry use succession planning?

Explanation:

The answer choice number B would not be relevant for Maria Boyd strategy. Succession planning is related to the passing of ownership of the business. and Maria is not in charge of devising ownership schemes, but in charge of implementing a corporate policy in order to improve employee retetion, and reduce in this way, employee turnover.

Answer:

b. What percentage of employers in the service industry use succession planning

Explanation:

GOT IT RIGHT ON TEST 2020

Landhill Corporation is authorized to issue 49,000 shares of $5 par value common stock. During 2020, Sandhill took part in the following selected transactions.

1. Issued 4,500 shares of stock at $45 per share, less costs related to the issuance of the stock totaling $7,900.

2. Issued 1,100 shares of stock for land appraised at $49,000. The stock was actively traded on a national stock exchange at approximately $46 per share on the date of issuance.

3. Purchased 470 shares of treasury stock at $41 per share. The treasury shares purchased were issued in 2016 at $38 per share.

Required:

a. Prepare the journal entry to record item 1.

b. Prepare the journal entry to record item 2.

c. Prepare the journal entry to record item 3 using the cost metho

Answers

Answer: Please see answer in explanation column

Explanation:

1. Journal to record common stock issued

Account title Debit Credit

Cash $210,400

Common stock $22,500

Paid in capital in excess of par $187,900

common stock

Calculation:

Cash = 4,500 x $45 + $7900= $210,400

Common stock =4,500 x $5=$22,500

Paid in capital in excess of par common stock = Cash - Common stock =$210,400-$22,500=$187,900

2) To reccord Land purchased in exchange of common stock

Account title Debit Credit

Land $50,600

Common stock $ 5,500

Paid in capital in excess of par $45,100

common stock

Calculation:

Land= 1,100 x $46 = $50,600

Common stock =1,100 x $5=$5,500

Paid in capital in excess of par common stock = 1100 x (46-5)$41=45,100

3) To record purchase of treasury stock

Account title Debit Credit

Treasury stock $19,270

Cash $19,270

Calculation:

Treasury stock = 470 shares x$41= $19,270

today ,I am happy I help my grandma

Answers

Following are several figures reported for Allister and Barone as of December 31, 2015:

Allister Barone

Inventory $50,000 $300,000

Sales 1,000,000 8,00,000

Investment income Not given

Cost of goods sold 500,000 400,000

Operating expenses 230,000 300,000

Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $66,000 that was unrecorded on its accounting records and had a six-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $135,000 to Allister for $190,000. Of this amount, 20 percent remains unsold in Allister's warehouse at year-end.

Determine balances for the following items that would appear on Allister's consolidated financial statements for 2015:

a. Inventory

b. Sales

c. Cost of Goods Sold

d. Operating Expenses

e. Net Income Attributable to Non-controlling Interest

Answers

Answer:

a. $344,500

b. $1,610,000

c. $405,500

d. $530,000

e. $9,550 loss

Explanation:

First, Eliminate the Intragroup transactions as follows :

Elimination Journal for the Intragroup Sale :

Sales (Barone) $190,000 (debit)

Cost of Sales (Allister) $190,000 (credit)

Elimination of unrealized profit in closing inventory :

Cost of Sales (Barone) $5,500 (debit)

Inventory (Allister) $5,500 (credit)

Unrealized Profit in Inventory ($190,000 - $135,000) × 10% = $5,500

Then, Consolidate the Financial Statements taking into account the elimination journals

Note : Consolidation is 100% of Parent + 100% of Subsidiary.

Note : A firm that is exercising control (> 50% Voting Rights) is required to prepare Consolidated Financial Statements - IFRS 3.

Consolidated Income Statement

Sales (1,000,000 + 8,00,000 - $190,000) $1,610,000

Cost of Sales ( $500,000 + 400,000 - $190,000 + $5,500) ($715,500)

Gross Profit $894,500

Less Operating Expenses ($230,000 + $300,000) ($530,000)

Net Income $364,500

Consolidated Financial Statement (Extract)

Inventory ($50,000 + $300,000 - $5,500) $344,500

Subsidiary Profit

Net Income Attributable to Non-controlling Interest

Net Income Attributable to Non-controlling Interest = Net Subsidiary Income × % Non Controlling Interest

Net Subsidiary Income - Barone

Sales (800,000 - 190,000) $610,000

Less Cost of Sales ( 400,000 + 5,500) ($405,500)

Gross Profit $204,500

Less Operating Expenses ($300,000)

Net Income/ (loss) ($95,500)

Therefore,

Net Income Attributable to Non-controlling Interest = ($95,500) × 10%

= $9,550 loss

Suppose you receive at the end of each year for the next three years. a. If the interest rate is , what is the present value of these cash flows? b. What is the future value in three years of the present value you computed in (a)? c. Suppose you deposit the cash flows in a bank account that pays interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? How does the final bank balance compare with your answer in (b)?

Answers

Answer:

the question is missing the numbers, so I looked for a similar question:

Suppose you receive $100 at the end of each year for the next three years. a. If the interest rate is 8%, what is the present value of these cash flows? (Answer: $257) b. What is the future value in three years of the present value you computed in (a)? (Answer: $324.61) c. Suppose you deposit the cash flows in a bank account that pays 8% interest per year. What is the balance in the account at the end of each of the next three years (after your deposit is made)? How does the final bank balance compare with your answer in (b)?

a) PV = $100/1.08 + $100/1.08² + $100/1.08³ = $257.71

b) FV = $257.71 x (1 + 8%)³ = $324.64

c) FV = ($100 x 1.08²) + ($100 x 1.08) + $100 = $324.64

it is exactly the same as the answer for (b)

Mcmurtry Corporation sells a product for $250 per unit. The product's current sales are 13,600 units and its break-even sales are 10,608 units. The margin of safety as a percentage of sales is closest to:

Answers

Answer:

22%

Explanation:

Margin of Safety is the amount by which sales can fall before making a loss.

Margin of Safety = Expected Sales - Break-even Sales ÷ Expected Sales

= (13,600 - 10,608) ÷ 13,600

= 0.22 or 22%

Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours.

During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year:

Machine-hours 76,000

Manufacturing overhead cost $637,000

Inventories at year-end:

Raw materials $20,000

Work in process (includes overhead applied of $36,480) $115,800

Finished goods (includes overhead applied of $91,200) $289,500

Cost of goods sold (includes overhead applied of $480,320) $1,524,700

Required:

a. Compute the underapplied or overapplied overhead.

b. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

c. Assume that the company allocates any underapplied or over appliedoverhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

d. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold?

Answers

Answer:

Please solution below

Explanation:

a. Compute the under applied or over applied overhead

First, we need to determine the predetermined overhead rate.

Predetermined overhead rate = Estimated total manufacturing overhead / Estimated total machine hours

= $900,000 / 75,000 hours

= $12.0 per hour

But;

Actual manufacturing overhead = $637,000

Manufacturing overhead applied to work in process during the year = 76,000 actual MHs × $12.00 per MH $912,000

Over applied overhead cost = $275,000

b. Journal entry

Cost of goods sold Dr $275,000

To Manufacturing over head applied Cr $275,000

c. The over applied over head would be allocated using the following percentages;

Overhead applied during the year ;

Work in process = $36,480. 6%

Finished goods = $91,200. 15%

Cost of goods sold = $480,320 79%

Total = $608,000 100%

The entry to record the allocation of the overhead applied would be ;

Work in process [6% × $275,000] = $16,500

Finished goods [15% × $275,000] = $41,250

Cost of goods sold [79% × $275,000] = $217,250

d. Comparing the two method;

Cost of goods sold if the over applied overhead is closed to the cost of goods sold [$1,524,700 + $275,000] = $1,799,700

Cost of goods sold if the overhead applied is closed to work in process, finished goods, and cost of goods sold = [$1,524,700 + $217,250] =

$1,741,950

Difference in cost of goods sold = $57,750

Question 5 of 10

Why do business often add fees to their invoices?

O A. To help pay for business expenses

B. To attract new customers

C. To reward customers' for their loyalty

D. To make more profit than their competitors

Answers

Answer: I think it's A

Explanation:

Answer:

Its A!

Explanation:

Just took the quiz

In early 2016, the same Germany machinery company has interest from four prospective clients from emerging markets: Indonesia, Brazil, Russia, and South Africa. They all want to buy ten machines, but the factory can only produce ten in time. Therefore, the company has to choose only one client. Given the volatility of the domestic currencies of the four prospective clients, the CFO would like to choose the client which is least likely to cancel the order due to currency volatility. The invoice comes due on June 30, 2016. According to volatility alone, which prospective client would be most likely to cancel the order?

Answers

Answer:

Brazil

Explanation:

According to the picture below, Brazilian real is the currency that has the lowers currency volatility, its spot is 4.0685, and its forward is 4.1820. These values are way lower than the values of the other three currencies, and for this reason, the CFO should choose the Brazilian client, clearly.

Indonesia is the country that is most likely to cancel this order. This is due to its high volatility.

Following the volatility chart that is attached to this question we can clearly spot that Indonesia has the most likelihood to cancel the order.

The volatility of the currency of the country Indonesia is shown to be high and this high volatility is very much going to have an impact on trade.

When there is a weakness in the currency of a nation, the cost of import would go up.

Read more on https://brainly.com/question/13694329?referrer=searchResults

You have a tax basis of ​$ and a useful life of five years and no salvage value. Provide a depreciation schedule ​(dk for k1​5) for ​% declining balance with switchover to straight line. Specify the year to switchover. Determine the depreciation amounts using the ​% declining balance and​ straight-line methods and BV amounts for each year

Answers

Answer:

the numbers are missing, so I will use another question as an example:

the asset's cost is $100,000useful life is 5 yearsno salvage value150% declining balancestraight line depreciation = $100,000 / 5 = $20,000

150% declining balance depreciation year 1 = 1.5 x $100,000 x 1/5 = $30,000, since it is higher than straight line we will use declining balance

book value at end of year 1 = $100,000 - $30,000 = $70,000

straight line deprecation = $70,000 / 4 = $17,500

150% declining balance depreciation year 2 = 1.5 x $70,000 x 1/5 = $28,000, since it is higher than straight line we will use declining balance

book value at end of year 2 = $70,000 - $28,000 = $42,000

straight line depreciation = $42,000 / 3 = $14,000, since it is higher than declining balance we will use straight line ⇒ switchover year

150% declining balance depreciation year 3 = 1.5 x $42,000 x 1/5 = $12,600

book value at end of year 3 = $42,000 - $14,000 = $28,000

depreciation year 4 = $14,000 (straight line)

book value at end of year 4 = $28,000 - $14,000 = $14,000

depreciation year 5 = $14,000 (straight line)

book value at end of year 5 = $14,000 - $14,000 = $0

Cash flows from operations may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may not be able to always generate enough cash flow to maintain a surplus of cash. Firms prefer to borrow now to fulfill their capital requirements through means of short-term financing or long-term financing. Both methods have their advantages and disadvantages.

The following statement identifies a possible characteristic of short-term financing.

Consider this case:

Short-term loans usually have a lower cost than long-term loans. Identify whether the preceding statement is true or false.

a. This statement is false and a disadvantage of short-term financing.

b. This statement is true and an advantage of short-term financing.

Firms use a variety of short-term financing sources to support working capital. Use the descriptions in the following table to identify the short-term financing source.

Description Short-Term Financing Source

A formal, committed line of credit extended by a bank or other lending institution.

An obligation backed by collateral, often inventories or accounts receivable.

Answers

Answer:

1. Consider this case:

Short-term loans usually have a lower cost than long-term loans. Identify whether the preceding statement is true or false.

a. This statement is false and a disadvantage of short-term financing.

2. Identify the short-term financing source:

An obligation backed by collateral, often inventories or accounts receivable.

Explanation:

Some organizations regularly require short-term financing to ease uneven cash flows. It is also called working capital financing. Its duration is less than 12 months, unlike long-term financing that can last more than two years. Most of this financing is arranged with banks in the form of bank overdraft.

Leach Inc. experienced the following events for the first two years of its operations:

Year 1:

Issued $10,000 of common stock for cash.

Provided $78,000 of services on account.

Provided $36,000 of services and received cash.

Collected $69,000 cash from accounts receivable.

Paid $38,000 of salaries expense for the year.

Adjusted the accounting records to reflect uncollectible accounts expense for the year.

Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible.

Closed the revenue account. Closed the expense account.

Year 2:

Wrote off an uncollectible account for $650.

Provided $88,000 of services on account.

Provided $32,000 of services and collected cash.

Collected $81,000 cash from accounts receivable.

Paid $65,000 of salaries expense for the year.

Adjusted the accounts to reflect uncollectible accounts expense for the year.

Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible.

Required

a. Record the Year 1 and Year 2 events in general journal form and post them to T-accounts.

b. Prepare the income statement, statement of changes in stockholders’ equity, balance sheet, and statement of cash flows for Year 1 and Year 2.

c. What is the net realizable value of the accounts receivable at Year 1 and Year 2?

Answers

Answer:

a.1) year 1

Issued $10,000 of common stock for cash.

Dr cash 10,000

Cr common stock 10,000

Provided $78,000 of services on account.

Dr accounts receivable 78,000

Cr service revenue 78,000

Provided $36,000 of services and received cash.

Dr cash 36,000

Cr service revenue 36,000

Collected $69,000 cash from accounts receivable.

Dr cash 69,000

Cr accounts receivable 69,000

Paid $38,000 of salaries expense for the year.

Dr wages expense 38,000

Cr cash 38,000

Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible.

Dr bad debt expense 450

Cr accounts receivable 450

Closed the revenue account. Closed the expense account.

Dr service revenue 114,000

Cr income summary 114,000

Dr income summary 38,450

Cr wages expense 38,000

Cr bad debt expense 450

Dr income summary 75,550

Cr retained earnings 75,550

b.1) income statement year 1Service revenue $114,000

Expenses:

Wages $38,000Bad debt $450 ($38,450)Net income $75,550

balance sheet year 1Assets:

Cash $77,000

Accounts receivable $8,550

total assets $85,550

Equity:

Common stock $10,000

Retained earnings $75,550

total equity $85,550

statement of cash flows year 1Cash flows form operating activities:

Net income $75,550

adjustments:

Increase in accounts receivable ($8,550)

net cash from operating activities $67,000

Cash flow from financing activities:

Common stocks issued $10,000

Net cash increase $77,000

beginning cash balance $0

Ending cash balance $87,000

a.2) Year 2:

Wrote off an uncollectible account for $650.

Dr bad debt expense 650

Cr accounts receivable 650

Provided $88,000 of services on account.

Dr accounts receivable 88,000

Cr service revenue 88,000

Provided $32,000 of services and collected cash.

Dr cash 32,000

Cr service revenue 32,000

Collected $81,000 cash from accounts receivable.

Dr cash 81,000

Cr accounts receivable 81,000

Paid $65,000 of salaries expense for the year.

Dr wages expense 65,000

Cr cash 65,000

Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible.

Dr bad debt expense 745

Cr accounts receivable 745

b.2) income statement year 2Service revenue $120,000

Expenses:

Wages $65,000Bad debt $1,395 ($38,450)Net income $53,605

balance sheet year 2Assets:

Cash $125,000

Accounts receivable $14,155

total assets $139,155

Equity:

Common stock $10,000

Retained earnings $129,155

total equity $139,155

statement of cash flows year 2Cash flows form operating activities:

Net income $53,605

adjustments:

Increase in accounts receivable ($5,605)

net cash from operating activities $48,000

Net cash increase $48,000

beginning cash balance $77,000

Ending cash balance $125,000

c) net realizable value of accounts receivable at year 1 = $8,550

net realizable value of accounts receivable at year 2 = $14,155

a. Recording the Year 1 and Year events in general journal form and posting to T-accounts for Leach Inc. are as follows:

General JournalYear 1:

Debit Cash $10,000

Credit Common stock $10,000

Debit Accounts Receivable $78,000

Credit Service Revenue $78,000

Debit Cash $36,000

Credit Service Revenue $36,000

Debit Cash $69,000

Credit Accounts Receivable $69,000

Debit Salaries Expense $38,000

Credit Cash $38,000

Adjustment:

Debit Bad Debts Expense $450

Credit Uncollectible Allowance $450

Year 2:

Debit Accounts Receivable $650

Credit Uncollectible Allowance $650

Debit Accounts Receivable $88,000

Credit Service Revenue $88,000

Debit Cash $32,000

Credit Service Revenue $32,000

Debit Cash $81,000

Credit Accounts Receivable $81,000

Debit Salaries Expense $65,000

Credit Cash $65,000

Adjustment:

Debit Bad Debts Expense $968

Credit Uncollectible Allowance $968

T-accounts:Year 1:

Cash AccountCommon stock $10,000

Service Revenue $36,000

Accounts Receivable $69,000

Salaries Expense $38,000

Balance $77,000

Uncollectible AllowanceBad debts Expense $450

Common Stock

Cash account $10,000

Accounts Receivable

Service Revenue $78,000

Cash $69,000

Balance $9,000

Service RevenueAccounts Receivable $78,000

Cash $36,000

Income Summary $114,000

Salaries ExpenseCash $38,000

Income Summary $38,000

Bad Debts Expense

Uncollectible Allowance $450

Income Summary $450

Year 2:

Cash AccountBalance $77,000

Service Revenue $32,000

Accounts Receivable $81,000

Salaries Expense $65,000

Balance $125,000

Uncollectible AllowanceBalance $450

Accounts Receivable $650

Bad debts expense $968

Balance $768

Common StockBalance $10,000

Accounts Receivable

Balance $9,000

Service Revenue $88,000

Uncollectible allowance $650

Cash $81,000

Balance $15,350

Service RevenueAccounts Receivable $88,000

Cash $32,000

Income Summary $120,000

Salaries ExpenseCash $65,000

Income Summary $65,000

Bad Debts Expense

Uncollectible Allowance $968

Income Summary $968

b. The preparation of the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 1 and Year 2 are as follows:

Leach Inc.

Income Statements for Year 1 and Year 2:Year 1 Year 2

Service Revenue $114,000 $120,000

Salaries Expense 38,000 $65,000

Bad Debts Expense 450 38,450 968 65,968

Net income $75,550 $54,032

Leach Inc.

Statements of Changes in Stockholders' Equity for Year 1 and Year 2:Year 1 Year 2

Beginning balance $10,000 $85,550

Net income 75,550 54,032

Ending balance $85,550 $139,582

Leach Inc.

Balance Sheets at Year 1 and Year 2:Year 1 Year 2

Assets:

Cash $77,000 $125,000

Accounts Receivable 9,000 15,350

Uncollectible Allowance (450) (768)

Total assets $85,550 $139,582

Equity:

Ending balance $85,550 $139,582

Leach Inc.

Statements of Cash Flows for Year 1 and 2:Operating Activities: Year 1 Year 2

Net income $75,550 $54,032

Changes in working capital:

Accounts receivable (8,550) (6,032)

Operating cash flows $67,000 $48,000

Financing Activities:

Common Stock $10,000 $0

Increase in cash flows $77,000 $48,000

c. The net realizable value of the accounts receivable at Year 1 is $8,550 ($9,000 - $450) and Year 2 is $14,582 ($15,350 - $768).

Data Analysis:Year 1:

Cash $10,000 Common stock $10,000

Accounts Receivable $78,000 Service Revenue $78,000

Cash $36,000 Service Revenue $36,000

Cash $69,000 Accounts Receivable $69,000

Salaries Expense $38,000 Cash $38,000

Adjustment:

Bad Debts Expense $450 Uncollectible Allowance $450

Year 2:

Uncollectible Allowance $650 Accounts Receivable $650

Accounts Receivable $88,000 Service Revenue $88,000

Cash $32,000 Service Revenue $32,000

Cash $81,000 Accounts Receivable $81,000

Salaries Expense $65,000 Cash $65,000

Adjustment:

Bad Debts Expense $968 Uncollectible Allowance $968

= $968 ($650 + $768 - $450)

$768 ($15,350 x 5%)

Learn more about preparing financial statements at https://brainly.com/question/735261

The lowest amount a manufacturer can pay factory workers is an example of

an incentive.

a price floor.

a price ceiling.

an elastic service.

Answers

Answer:

The answer to this question is given below in the explanation section.

Explanation:

The correct answer to this question is the price floor.

The Price floor is the lowest amount that is imposed by the government or group-imposed lowest price limit for a product or service. The government uses the price floor to keep prices at a certain level from going to low. So price floors for workers set by the government that the employer should not pay less than the set amount.

while other options are not correct because::

The price ceiling is the high amount set by the government or the by other groups for a product or service.

An incentive is an amount or something that can be given to employees or someone for motivation or encouraging them to do something.

An elastic service is given by amazon to develop and run the application with different tools etc.

Answer:price floor

Explanation:

You are invested in two hedge funds. The probability that hedge fund Alpha generates positive returns in any given year is 60%. The probability that hedge fund Omega generates positive returns in any given year is 70%. Assume the returns are independent. What is the probability that both funds generate positive returns in a given year? What is the probability that both funds lose money?

Answers

Answer:

42% and 12%

Explanation:

The computation is shown below:

For Alpha Fund

Positive return = 60%

Lose money is

= 1 - 0.60

= 40%

For Omega Fund

Positive return = 70%

Lose money is

= 1 - 0.70

= 0.30

Also the returns are non-dependent

Now the positive return is

= 60% × 70

= 42%

And, the probability of lose money is

= 40% × 30%

= 12%

Larkspur Incorporated factored $124,300 of accounts receivable with Cullumber Factors Inc. on a without-recourse basis. Cullumber assesses a 2% finance charge of the amount of accounts receivable and retains an amount equal to 5% of accounts receivable for possible adjustments.

Required:

Prepare the journal entry for Larkspur Incorporated and Cullumber Factors to record the factoring of the accounts receivable to Cullumber.

Answers

DR Cash 115,599

Due from Factor (Cullumber) 6,215

Loss on Sale of Receivables 2,486

CR Accounts Receivable 124,300

Working

Due from Factor = 5% * 124,300

= $6,215

Loss on sale of receivables = 2% * 124,300

= $2,486

Cash = 124,300 - 6,215 - 2,486

= $115,599

Cullumber Factors Inc.DR Accounts Receivable 124,300

CR Due to Larkspur 6,215

Financing Revenue 2,486

Cash 115,599

Presented below is information from Headland Computers Incorporated.

July 1 Sold $22,600 of computers to Robertson Company with terms 3/15, n/60. Headland uses the gross method to record cash discounts. Headland estimates allowances of $1,334 will be honored on these sales.

10 Headland received payment from Robertson for the full amount owed from the July transactions.

17 Sold $256,100 in computers and peripherals to The Clark Store with terms of 2/10, n/30.

30 The Clark Store paid Headland for its purchase of July 17.

Answers

Answer:

July 1

Dr Accounts receivable $22,600

Cr Cash $22,600

Dr Sales returns and allowances $1,334

Cr Allowances for Sales returns and allowances $1,334

July 10

Dr Cash $21,922

Dr Sales Discount $678

Cr Accounts Receivable $22,600

July 17

Dr Accounts receivable $256,100

Cr Sales revenue $256,100

July 30

Dr Cash $256,100

Cr Accounts receivable $256,100

Explanation:

Preparation of Journal entry

July 1

Dr Accounts receivable $22,600

Cr Cash $22,600

Dr Sales returns and allowances $1,334

Cr Allowances for Sales returns and allowances $1,334

July 10

Dr Cash $21,922

(97%×$22,600)

Dr Sales Discount $678

(3%×$22,600)

Cr Accounts Receivable $22,600

($21,922+$678)

July 17

Dr Accounts receivable $256,100

Cr Sales revenue $256,100

July 30

Dr Cash $256,100

Cr Accounts receivable $256,100

Blight Financial has an investment in bonds issued by Searing Industries that are classified as trading securities. At December 31, Year 2, the Investment in Searing bonds account had a debit balance of $500,000, and the bonds were purchased at par so the $500,000 equals amortized cost. The Fair Value Adjustment account had a debit balance of $20,000. On December 31, Year 3, the amortized cost of those bonds has not changed, but the fair value of those bonds was $515,000. Which of the following will be included in the related journal entry dated December 31, Year 3?

a. Debit to Fair value adjustment for $5,000.

b. Credit to Fair value adjustment for $5,000.

c. Debit to Fair value adjustment for $25,000.

d. Credit to Fair value adjustment for $25,000.

Answers

Answer:

b. Credit to Fair value adjustment for $5,000.

Explanation:

Particulars Amount

Beginning balance of fair value adjustment $20,000

Less: Unrealized gain on Dec 31 $15,000

(515,000 - 500,000)

Credit to fair value adjustment $5,000