Donner Racket Company manufactures two types of tennis rackets, the Junior and Pro Striker models. The production budget for March for the two rackets is as follows:

Junior Pro Striker

Production budget 18,000 units 10,000 units

Both rackets are produced in two departments, Forming and Assembly. The direct labor hours required for each racket are estimated as follows:

Forming Department Assembly Department

Junior 0.20 hour per unit 0.60 hour per unit

Pro Striker 0.35 hour per unit 0.75 hour per unit

The direct labor rate for each department is as follows:

Forming Department $21 per hour

Assembly Department $16 per hour

Required:

Prepare the direct labor cost budget for March. Enter all amounts as positive numbers.

Answers

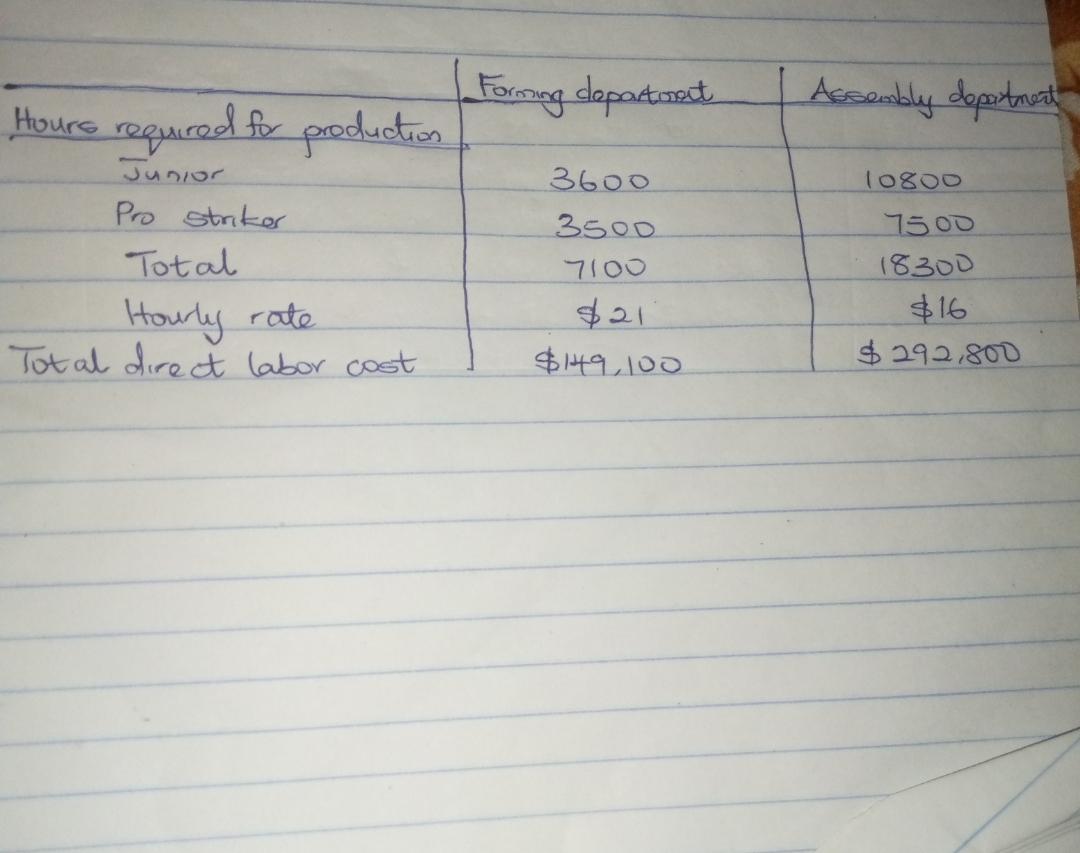

Answer: Check attachment

Explanation:

The direct labor cost budget for March has been attached.

Note that:

For Junior Models:

Forming Department = 18,000 units × 0.20 = 3,600

Assembly Department = 18,000 units * 0.60 = 10,800

For Pro striker Models:

Forming Department = 10,000 × 0.35 = 3,500

Assembly Department = 10,000 × 0.75 = 7,500

Check attachment for complete solution.

Related Questions

What is the first element that should be considered in creating an

advertisement?

Answers

Answer:

UNDERSTANDING THE PRODUCT DNA::

the first element is recognise the idea behind the product or service.For example if you are selling "bespoke clothing line" then the idea behind is 'luxury'. therefore, the advertising campaign must revovle around luxury.

Answer:

the message

Explanation:

Winston Enterprises would like to buy some additional land and build a new factory. The anticipated total cost is $175.86 million. The owner of the firm is quite conservative and will only do this when the company has sufficient funds to pay cash for the entire expansion project. Management has decided to save $670,000 a month for this purpose. The firm earns 6 percent compounded monthly on the funds it saves. How long does the company have to wait before expanding its operations

Answers

Answer:

the time period is 168.07 months

Explanation:

The computation of the time period is shown below:

Given that

RATE = 6% ÷ 12 = 0.5%

PMT = $670,000

FV = $175,860,000

PV = $0

The formula is shown below:

= NPER(RATE;PMT;-PV;FV;TYPE)

After applying the above formula, the time period is 168.07 months

Sophia just graduated from college. She just sold the furniture from her college apartment for $450 in cash. She just deposited $2,700 in graduation money into her checking account and has $7,500 saved in her savings account from working part-time. She charged gas and groceries to her credit card that she hasn't paid off yet. The total balance on her credit card is $179. Sophia has driven the same car since high school that is valued at $3,254. She doesn't have an auto loan. Her total student loan amount after graduating is $54,178. What is Sophia's net worth? (Do not include the $ sign or commas in your answer).

Answers

Answer:

Sophia's Net Worth

Sophia's net worth is:

= ($40,453).

Explanation:

a) Data and Calculations:

Assets:

Proceeds from sale of furniture = $450

Checking account deposit = 2,700

Savings account 7,500

Car 3,254

Total assets $13,904

Liabilities:

Credit card $179

Student loan after graduating 54,178

Total liabilities $54,357

Sophia's net worth = ($40,453)

b) Sophia's net worth is in the negative because of the student loan. This implies that she is in debt. A negative net worth simply means that Sophia owes more than she owns. In other words, Sophia's liabilities exceed her assets' value.

A fierce debate exists between policymakers as to whether or not they should use monetary and fiscal policies to stabilize small fluctuations in the economy. Please determine which of the given statements could be used to support using policy to stabilize the economy and which might be used against such choices. In favor of using policy Not in favor of using policy

Answers

Answer:

Hello the options related to your question is missing attached below are the missing options

answer :

In favor of using policy

Fiscal policy can be used to cut spending and rein in excessive aggregate demand. This controls inflationPolicy makers can expand the money supply in order to increase aggregate demandNot in favor of using policy

Fiscal policy, in particular is subject to long delays in the political process, which can affect its usefulnessMonetary and fiscal policy only take effect after a long lagBecause of the imprecision of economic forecasting, policy makers may end up causing more harm to the economy than goodExplanation:

Fiscal policy is simply the use of government, taxing and spending policy to influence the economic conditions of the country positively over time. and it can come in either ways. i.e. increase in government spending or lowering taxes by the government

In favor of using policy

Fiscal policy can be used to cut spending and rein in excessive aggregate demand. This controls inflationPolicy makers can expand the money supply in order to increase aggregate demandNot in favor of using policy

Fiscal policy, in particular is subject to long delays in the political process, which can affect its usefulnessMonetary and fiscal policy only take effect after a long lagBecause of the imprecision of economic forecasting, policy makers may end up causing more harm to the economy than goodOn January 1, James Industries leased equipment to a customer for a five-year period, at which time possession of the leased asset will revert back to James. The equipment cost James $830,000 and has an expected useful life of seven years. Its normal sales price is $830,000. The residual value after five years is $200,000. Lease payments are due on December 31 of each year, beginning with the first payment at the end of the first year. The interest rate is 8%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Calculate the amount of the annual lease payments.

Answers

Answer:

James Industries

The amount of the annual lease payments is:

= $207,878.86.

Explanation:

a) Data and Calculations:

Cost of equipment = $830,000

Normal sales price = $830,000

Residual value after 5 years = $200,000

Interest rate = 8%

Lease period = 5 years

From an online financial calculator:

Loan Amount 830000

Loan Term 5 years

Interest Rate 8

Results:

Payment Every Year $207,878.86

Total of 5 Payments $1,039,394.29

Total Interest $209,394.29

Lease Payment Schedule:

Period PV PMT Interest FV

1 $830,000.00 $-207,878.86 $66,400.00 $-688,521.14

2 $688,521.14 $-207,878.86 $55,081.69 $-535,723.98

3 $535,723.98 $-207,878.86 $42,857.92 $-370,703.04

4 $370,703.04 $-207,878.86 $29,656.24 $-192,480.42

5 $192,480.42 $-207,878.86 $15,398.43 $0.00

Marshall Welding Company has two service departments (Cafeteria and Human Resources) and two production departments (Machining and Assembly). The number of employees in each department follows. Cafeteria 20 Human Resources 30 Machining 100 Assembly 150 Marshall Welding uses the step-down method of cost allocation and allocates cost on the basis of employees. Human Resources cost amounts to $1,200,000, and the department provides more service to the firm than Cafeteria. How much Human Resources cost would be allocated to Cafeteria

Answers

Answer: $88,889

Explanation:

Based on the information given in the question, the cost of Human Resources that would be allocated to Cafeteria will be calculated thus:

Number of employees (Human Resources to departments)

= 20 + 100 + 150

= 270 employees

The Human Resources cost would be allocated to Cafeteria will be:

= $1,200,000 / 270 x 20

= $88,889

what is the bad side of profit motive?

Answers

Answer:

The profit motive that drives companies and individuals all too often gives way to greed. The power of leadership all too often gives way to elitist domination. The accumulation of wealth can look like excess or hoarding while income inequality increases in economies around the globe

Tandy Company was issued a charter by the state of Indiana on January 15 of this year. The charter authorized the following: Common stock, $7 par value, 119,000 shares authorized Preferred stock, 15 percent, par value $6 per share, 6,000 shares authorized During the year, the following transactions took place in the order presented: a. Sold and issued 21,300 shares of common stock at $12 cash per share. b. Sold and issued 1,900 shares of preferred stock at $16 cash per share. c. At the end of the year, the accounts showed net income of $41,400. No dividends were declared.

Answers

Answer:

$327,400

Explanation:

Preparation of the stockholders' equity section of the balance sheet at the end of the year.

TANDY, INCORPORATED Balance Sheet (Partial) At December

TANDY, INCORPORATED

Balance Sheet (Partial)

At December 31, this year

Stockholders' equity:

Contributed capital:

Common stock $149,100

(21,300*$7)

Additional paid-in capital, common stock $106,500

[21,300 x (12-7)]

Common stock - Contributed capital $255,600

($149,100+$106,500)

Preferred stock $11,400

(1,900*$6)

Additional paid-in capital, Preferred stock $19,000

[1,900 x (16-6)]

Preferred stock - Contributed capital $30,400

($11,400+$19,000)

Total Contributed Capital $286,000

($255,600+$30,400)

Retained earnings $41,400

Total Stockholders' equity $327,400

($286,000+$41,400)

Therefore the stockholders' equity section of the balance sheet at the end of the year will be $327,400

A company is investing in a solar panel system to reduce its electricity costs. The system requires a cash payment of $118,982.50 today. The system is expected to generate net cash flows of $10,209 per year for the next 35 years. The investment has zero salvage value. The company requires an 7% return on its investments. 1-a. Compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) 1-b. Should the project be accepted

Answers

Answer and Explanation:

The computation of the net present value is given below:

a.

As we know that

Net present value

= Annual cash inflows × PVIFA factor at 7% for 35 years - initial investment

= $10,209 × 12.9477 - $118,982.50

= $132,183.0693 - $118,982.50

= $13,200.57

Hence, the net present value is $13,200.57

b. Yes the project should be accepted as it net present value comes in positive amount

A local college is deciding whether to conduct a campus beautification initiative that would involve various projects, such as planting trees and remodeling buildings, to make the campus more aesthetically pleasing.

For the students of the college, the visual appearance of the campus is_________and __________ . Thus, the visual appearance would be classified as a public good.

Suppose the college administrators estimate that the beautification initiative will cost $7,200. To decide whether the initiative should be undertaken, administrators conduct a survey of the college's 300 students, asking each of them their willingness to pay for the beautification project. The average willingness to pay, as revealed by the survey, is $18.

Answers

Answer:

Non rival and non excludable

Explanation:

if the visual appearance is classified as a public good, then it is non-rival and non excludable.

In economics, a public good is described with these two characteristics. such goods are non rivalrous and also without excludability.

if mr A is using such a good, it does not prevent mr B from using it also. Also Mr A cannot exclude Mr B from using it

the benefit of the beautification initiative = $18*300

= 5400

Tim, a single taxpayer, operates a business as a single-member LLC. In 2020, his LLC reports business income of $382,000 and business deductions of $668,500, resulting in a loss of $286,500. What are the implications of this business loss

Answers

Answer: See explanation

Explanation:

First, it should be noted that a threshold limit of $250,000 applies to the question according to IRS since Tim is a single taxpayer.

Therefore, the excess business loss will be:

= $286,500 - $250,000

= $36500

Therefore, Tim can use $250000 out of the loss of $286,500 to offset the non business income. Then, the excess business loss of $36500 will be treated as part of the NOL carryforward for Tim.

A consumer electronics company is in the process of evaluating whether it should pursue an internal development strategy or an external growth strategy. To make this decision, the management needs to assess whether the company's internal resources are superior to those of competitors in the targeted area. Which of the following strategic management models would be most useful in this assessment?

a. the core competence matrix.

b. the Boston Consulting Group (BCG) matrix.

c. the transaction-cost economics model.

d. the VRIO framework.

Answers

Answer:

Option d: The VRIO framework

Explanation:

The VRIO Framework?

This simply talks about (explains) and tells (predicts) firm-level competitive advantage. It is said to uncovers sustained competitive advantage.

VRIO is an acronym for a four-question framework which makes up the 4 components of the VRIO Framework. It includes;

1. Valuable

2. Rare

3. Costly to Imitate

4. Organized to Capture.

VRIO as Valuable means it has attractive features and has low cost and price in its design and build.

VRIO as Rare means only a few firms posses it.

VRIO as Costly to Imitate means that it is difficult to be developed or bought at a reasonable price.

VRIO as Organized to Capture means it exploit competitive potential.

You are considering buying a new car worth $25,000 today. The dealership will allow you to pick the car today and pay nothing until after you graduate in four years. After four years, you will make a lumpsum payment. You have two financing options. 1) let the dealership finance it for you or 2) finance it yourself though your investment at a local credit union that earns 8% per year. If you do a dealer financing, you will finance the loan for 4 years at 6% per year compounded monthly. If you choose this option, the dealer will throw in a 10% discount and hence you will only take a loan of 90% of the value of the car. You will do a onetime lumpsum payment to the dealer after 4 years. If you finance it yourself, you will pay additional $4,000 to the original value of the car at the time of payment. This means you will end up paying $29,000 to the dealership if you do not finance with them. You currently have a balance of $21,050 in your investment account at the credit union. Which option will you take

Answers

Answer:

Purchase of a New Car Worth $25,000

Based on the above calculations, it will be more profitable to pay through the dealership than through the investment account and additional borrowing, with a future value gain of $11,226 ($38,812 - $28,586)

Explanation:

a) Data and Calculations:

Present value of the new car = $25,000

Interest rate per month = 0.5% (6%/12)

Interest rate per year through self-finance = 8%

Amount to be paid after discount= $22,500 ($25,000*90%)

Amount to be paid through self-fiance = $29,000

Future value to be paid to the dealership in four years = $28,586

Future value of the Investment account of $21,050 after 4 years:

Future value factor = 1.360 (8% per year for 4 years)

Future value = $28,628 ($21,050 * 1.360)

Future value of excess funding required to self-finance = $10,812 ($29,000 - $21,050) * 1.360

Total cost of self-finance = $39,812 ($29,000 + 10,812)

Total cost through dealership 28,586

Difference $11,226

Future value to be paid to the dealership in 4 years from an online financial calculator:

N (# of periods) = 48 (4 * 12)

I/Y (Interest per year) = 0.5 (6%/12)

PV (Present Value) = $22500

PMT (Periodic Payment) = 0

Results

FV = $28,586.01

Total Interest $6,086.01

Two hundred paper mills compete in the paper market. The total cost of production (in dollars) for each mill is given by the formula TC = 500Qmill + (Qmill)2 where Qmill indicates the mills annual production in thousands of tons. The marginal cost of production is MC = 500 + 2Qmill. The external cost of a mill’s production (in dollars) is given by the formula EC = 40Qmill + (Qmill)2 and the marginal external cost of production is MEC = 40 + 2Qmill. Finally, annual market demand (in thousands of tons) is given by the formula Qd = 150,000 – 100P where P is the price of paper per ton. Using algebra, find the competitive equilibrium price and quantity, as well as the efficient quantity. Calculate the magnitude of the deadweight loss resulting from the externality. Illustrate your solution with graphs.

Answers

Answer: See explanation

Explanation:

The magnitude of the deadweight loss resulting from the externality is shown below:

MC = 500 + 2Q

MEC = 40 + 2Q

Therefore, the Marginal social cost (MSC) will be:

= MC + MEC

= 500 + 2Q + 40 + 2Q

= 540 + 4Q

Since Demand: Q = 150,000 - 100P, we have to get a function for P which will be:

Q = 150,000 - 100P

100P = 150,000 - Q

P = (150,000 - Q)/100

P = 1,500 - 0.01Q

Total revenue, TR = P x Q

= (1,500 - 0.01Q) × Q

= 1500Q - 0.01Q²

Marginal revenue, MR will be:

= dTR / dQ

= 1,500 - 0.02Q

It should be noted that for when there's no externality, Equilibrium, MC must be equal to MR. Therefore,

1,500 - 0.02Q = 500 + 2Q

2Q + 0.02Q = 1500 - 500

2.02Q = 1,000

Q = 1000/2.02

Q = 495

P = 1,500 - (0.01 x 495)

= 1,500 - 4.95

= 1,495.05

When there's externality, Equilibrium will be:

MR = MSC

1,500 - 0.02Q = 540 + 4Q

4.02Q = 960

Q= 960/4.02

Q = 239

Therefore, P = 1,500 - (0.01 x 239)

= 1,500 - 2.39

= 1,497.61

Then, we will calculate the deadweight loss which will be:

= 1/2 x Difference in price x Difference in quantity

= 1/2 x (1,497.61 - 1,495.05) x (495 - 239)

= 1/2 x 2.56 x 256

= 327.68

Which sentence best explains the mistake Maggie made? Her mortgage payments are high, and some months, she earns barely enough to cover the essentials. Because homeowner's insurance was an added expense, she considered taking her chances and not buying it. However, the bank made it clear that this was not an option... When the agent returned on the line, he sounded like a different person. "Ma'am, I'm sorry, but according to our records, you do not have flood insurance protections in your policy. We do offer flood insurance as an add-on to basic homeowner's, but at additional cost." O She failed to properly assess her risk of storm damage. She did not always make her insurance payments on time. O She refused to share the risk of living in an area known for hurricanes. O She should have worked with a different bank to purchase her home.

Answers

Answer:

She failed to properly assess her risk of storm damage.

Explanation: Edge 2021

Idaho Company sells 20,000 units of inventory during the first year of operations for $200 each. Idaho Company provides a one-year warranty on parts. It is estimated that 2% of the units will be defective and that repair costs are estimated to be $30 per unit. In the year of sale, warranty contracts are honored on 50 units for a total cost of $1,500. What amount will be reported as Estimated Warranty Liability at the end of the year

Answers

Answer:

the amount that would be reported as Estimated Warranty Liability at the end of the year is $10,500

Explanation:

The computation of the liability reported as estimated warranted liability is given below:

= (Defective cost - units honored) × estimated repair cost

= (20,000 units × 2% - 50 units) × $30 per unit

= (400 units - 50 units) × $30 per unit

= $10,500

Hence, the amount that would be reported as Estimated Warranty Liability at the end of the year is $10,500

Orchard Fresh, Inc., purchases apples from local orchards and sorts them into four categories. Grade A are large blemish-free apples that can be sold to gourmet fruit sellers. Grade B apples are smaller and may be slightly out of proportion. These are packed in boxes and sold to grocery stores. Apples for slices are even smaller than Grade B apples and have blemishes. Apples for applesauce are of lower grade than apples for slices, yet still suitable for canning. Information on a recent purchase of 22,000 pounds of apples is as follows: Grades Pounds Grade A 1,540 Grade B 5,500 Slices 7,700 Applesauce 7,260 Total 22,000 Total joint cost is $17,600. Required: 1. Allocate the joint cost to the four grades of apples using the physical units method.

Answers

Answer:

Apportioned joint cost

$

Graded A = 1,232

Grade B = 4,400

Slices = 6,160

Applesauce = 5,808

Explanation:

The joint cost can be apportioned using the physical units basis by getting the sum of the units produced for all the different products, And then use the the proportion of individual units to the total units as basis for apportioning the joint cost.

Apportioned joint cost:

Total units= 22,000

Graded A - 1,540/22,000× 17,600 = 1232

Grade B - 5,500/22,000× 17,600= 4400

Slices - 7,700/22,000× 17,600= 6,160

Applesauce- 7,260/22,000× 17,600 = 5,808

Apportioned joint cost

$

Graded A = 1232

Grade B = 4400

Slices = 6,160

Applesauce = 5,808

Which of the following is a gauge used to measure distance traveled?

Answers

Answer:

please give me brainlist and follow

Explanation:

An odometer or odograph is an instrument used for measuring the distance traveled by a vehicle, such as a bicycle or car. The device may be electronic, mechanical, or a combination of the two (electromechanical).

Entry for Issuing Materials

Materials issued for the current month are as follows:

Requisition No. Material Job No. Amount

103 Plastic 400 $ 2,800

104 Steel 402 24,000

105 Glue Indirect 1,620

106 Rubber 403 3,200

107 Titanium 404 31,600

Journalize the entry to record the issuance of materials.

For a compound transaction, if an amount box does not require an entry, leave it blank.

Work in Process

Factory Overhead

Materials

Answers

Answer:

Journal entry to record the issuance of materials

Date Accounts & explanation Debit Credit

Work in process $61,600

(2,800+24,000+3,200+31,600)

Factory overhead $1,620

Material $63,220

(To record the issuance of material)

Question 3

Which of the following changes in supply and demand will lead a product to become less scarce?

A decreased demand increased supply

B

increased demand, decreased supply

С

decreased demand, decreased supply

D

increased demand increased supply

Answers

"When auto manufacturer BMW purchased the Rollsminus Royce brand name, BMW had to hire and train a new staff of assembly workers. The new workers were paid $27 per hour, worked a total of 7,200 hours, and produced 2,100 cars. BMW budgeted for a standard labor rate of $32 per hour and 3.50 direct labor hours per car. What is the direct labor rate variance for the Rollsminus Royce division?"

Answers

Answer:

See now

Explanation:

With regards to the above, direct labor rate variance is computed as;

Direct labor rate variance

= Actual cost - Standard cost of actual hours

= [(7,200hours × $27) - (7,200 hours × $32)]

= $194,400 - $230,400

= $36,000 favorable

Therefore , direct labor rate variance i s $36,000 favorable

What is the first phase of the project process?

A. Monitoring

B. Pre-Planning

C. Implementation

D. Planning

Answers

Answer:Pre-planning

Explanation:

Answer:

Explanation:

Implementation and Monitoring are latter phases of a project. Pre-planning goes before Planning so the answer is B.

When a company uses outsourcing to zero in on even better performance of those truly strategy-critical activities where its expertise is most needed, then it may also be able to:________.

a. better police compliance with ethical standards, lower overall operating costs, and create two or more distinctive competencies.

b. devote more resources to its social responsibility strategy, better empower employees, and reduce employee turnover.

c. decrease internal bureaucracies, flatten its organizational structure, and shorten the time it takes to respond to changing market conditions.

d. create a values-based corporate culture that excels in product innovation.

e. reduce the potential for information overload and improve the quality of decision-making in each domain.

Answers

Answer:

c. decrease internal bureaucracies, flatten its organizational structure, and shorten the time it takes to respond to changing market conditions.

Explanation:

Outsourcing is the process where a business gives out part of its activities to a third party to handle.

They are no longer directly in control of the activity.

For example recruitmemt, procurement, and sales can be outsourced to third party companies.

In the given scenario. If a company uses outsourcing to zero in on those truly strategy-critical activities where its expertise is most needed, then it will reduce the bureacracy associated with outsourcing.

Employees of the company will have a shorter time to respond to changing market conditions.

Unlike when it is outsourced and one needs to communicate with a third party

Nu Things, Inc., is considering an investment in a business venture with the following anticipated cash flow results:

EOY Cash Flow

0 -$105,000

1 $26,000

2 $25,000

3 $24,000

4 $23,000

5 $22,000

6 $21,000

7 $20,000

8 $19,000

9 $18,000

10 $17,000

11 $16,000

12 $15,000

13 $14,000

14 $13,000

15 $12,000

16 $11,000

17 $10,000

18 $9,000

19 $8,000

20 $7,000

Assume MARR is 20% per year. Based on an external rate of return analysis.

Required:

Determine the investment's present worth.

Answers

Answer:

$-1304.20

Explanation:

We are to calculate the Net present value of the investment

Net present value is the present value of after-tax cash flows from an investment less the amount invested.

NPV can be calculated using a financial calculator

0 -$105,000

1 $26,000

2 $25,000

3 $24,000

4 $23,000

5 $22,000

6 $21,000

7 $20,000

8 $19,000

9 $18,000

10 $17,000

11 $16,000

12 $15,000

13 $14,000

14 $13,000

15 $12,000

16 $11,000

17 $10,000

18 $9,000

19 $8,000

20 $7,000

I = 20%

NPV= $-1,304.20

To find the NPV using a financial calculator:

1. Input the cash flow values by pressing the CF button. After inputting the value, press enter and the arrow facing a downward direction.

2. after inputting all the cash flows, press the NPV button, input the value for I, press enter and the arrow facing a downward direction.

3. Press compute

BOGO Inc. has two sequential processing departments, roasting and mixing. At the beginning of the month, the roasting department had 3,080 units in inventory, 70% complete as to materials. During the month, the roasting department started 21,600 units. At the end of the month, the roasting department had 4,800 units in ending inventory, 80% complete as to materials. Cost information for the roasting department for the month follows:

Beginning work in process inventory (direct materials) $ 4,870

Direct materials added during the month 45,900

Using the FIFO method, assign direct materials costs to the roasting department’s output—specifically, the units transferred out to the mixing department and the units that remain in process in the roasting department at month-end. (Do not round intermediate calculations.)

Answers

Answer:

Direct material cost of units transferred out = $42,596

Cost of ending work in process inventory = $8,174

Explanation:

This can be done using the following 3 steps:

Step 1: Calculation of equivalent unit of production (EUP) of materials

Note: See the attached excel file for the calculation of equivalent unit of production (EUP) of materials.

From the attached excel file, we have:

Physical unit = 24,680

EUP-material = 21,564

Step 2: Calculation of cost per EUP of materials

Cost per EUP of materials = Direct materials added during the month / EUP-Materials = $49,900 / 21,564 = $2.13

Step 3: Assignment of direct materials cost to the units transferred out amd the ending WIP

Cost of materials added to complete the beginning WIP = 924 * $2.13 = $1,967

Cost of units started and transferred out = 16,800 * $2.13 = $35,760

Direct material cost of units transferred out = Direct material cost of beginning WIP + Cost of materials added to complete the beginning WIP + Cost of units started and transferred out = $4,870 + $1,967 + $35,760 = $42,596

Cost of ending work in process inventory = 3,840 * $2.13 = $8,174

Select the correct example of a "benefits received" tax.

OA. Income tax.

OB. The tax that is collected at a toll booth on a highway.

Answers

Answer:

I’m thinking it’s A. But I’m not for sure

Explanation:

I looked it up ;)

Item1 10 points Time Remaining 59 minutes 50 seconds00:59:50 eBookItem 1 Time Remaining 59 minutes 50 seconds00:59:50 Denny Corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine. The new machine would cost $150,000 and would have a sixteen-year useful life. Unfortunately, the new machine would have no salvage value. The new machine would cost $20,000 per year to operate and maintain, but would save $50,000 per year in labor and other costs. The old machine can be sold now for scrap for $15,000. The simple rate of return on the new machine is closest to (Ignore income taxes.)

Answers

Answer:

Denny Corporation

The simple rate of return on the new machine is closest to:

= 13.75%.

Explanation:

a) Data and Calculations:

Cost of new machine = $150,000

Estimated useful life = 16 years

Salvage Value = $0

Annual depreciation expense = $9,375 ($150,000/16)

Operation and maintenance cost per year = $20,000

Savings in labor and other costs per year = $50,000

The net savings in costs per year = $30,000 ($50,000 - $20,000)

Incremental net income = $20,625 ($30,000 - $9,375)

The simple rate of return = Net Savings per year/Cost of new machine * 100

= $20,625/$150,000 * 100

= 13.75%

b) This simple rate of return of 13.75% does not account for inflation or the time value of the investment. So there is no discounting or calculation of the present values of the investment and the incremental net income. Instead, it considers the annual depreciation expense that is attributable to the investment.

The equation of exchange states

Answers

[tex] \texttt{The equation of exchange states}[/tex]

Anatomy of the Exchange Equation There are different variants of the equation (M * V = P * T, M * V = P * Y, M * V = P * Q,to take the simplest), but none of them is substantially different from the original formula of Fisher: [tex]{\boxed{ \boxed{ \bold{M * V = P * T.}}}}[/tex]----------------------------------------------------------------------------------------------

[tex] \bold{BRAINLYMENTALMENTE}[/tex]

To be included in property, plant, and equipment, an asset must have all of the following except Group of answer choices a. the asset must be held for use. b. the asset must have an expected life of a normal operating cycle. c. the asset must be tangible in nature. d. the asset must have an expected life of more than one year. g

Answers

Answer:

b. the asset must have an expected life of a normal operating cycle.

Explanation:

A current asset can be defined as all of the assets that are being owned by a company or business entity and are expected to be converted into their cash equivalent through sales or use within a period of one year of its date on the organization's balance sheet.

Hence, to be included in property, plant, and equipment, an asset must have all of the following;

I. The asset is expected or required to be held for use

II. It must be tangible in nature.

III. It is required to have an expected life of that is typically above a year.

Discrimination in the workplace is against "the golden rule" and also

Answers

Answer:

Discrimination in the workplace is against "the golden rule" and also generates situations of tension and conflict within the work environment, which ends up affecting the labor production of each individual, and therefore the economic benefits of the company.

In other words, discrimination in the workplace not only has ethical and moral connotations, which implies an undeserved mistreatment of a person, but that, in the workplace, the conflict that such discrimination generates may end up affecting the company's own economic production or entrepreneurship.