Answers

Answer: $20

Explanation:

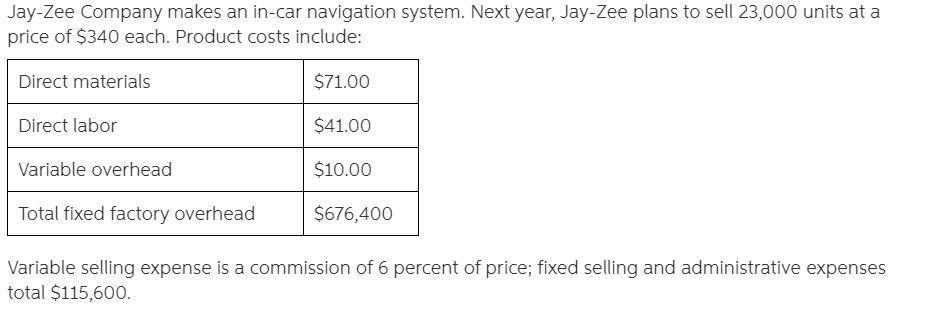

The sales commission is 6% and the selling price per unit is $340.

The Sales commission per unit saved therefore is;

= 340 * 6%

= $20.40

= $20

Related Questions

Rachel pushed very hard to go with Project A rather than Project B. There have been several cost overruns, the project is two weeks beyond its projected finish date, and the technology just isn't working out as planned. Rachel increases the funding for the third time and hires three new designers to help revamp the look of the product. Rachel is engaging in _____.

Answers

Answer: escalation of commitment

Explanation:

Escalation of commitment is when an individual or firm chooses an option which tends to be unsuccessful but the individual or firm still continues with the project because there has been investment which has already been made on it.

From the question, we are told that Rachel pushed very hard to go with Project A rather than Project B. From the information given, despite the fact that project A has been unsuccessful, Rachel continued with it and invested more in it rather than changing or leaving it for project B. This shows that Rachel is engaging in escalation of commitment.

Question 3

20 pts

Solve the problem

A normal distribution has a limited range and can be skewed in either direction.

True

0 False

Next >

Answers

Performance Obligation Fulfilled Over Time Philbrick Company signed a three-year contract to develop custom sales training materials and provide training to the employees of Elliot Company. The contract price is $1,100 per employee and the number of employees to be trained is 500. Philbrick can send a bill to Elliot at the end of every training session. Once developed, the custom training materials will belong to Elliot Company, but Philbrick does not consider them to be a separate performance obligation. The expected number to be trained in each year and the expected development and training costs follow. Number of employees Development and training costs incurred

2019

150 $

55,000

2020

250

70,000

2021

100

20,000

Total 500 $145,000

For each year, compute the revenue, expense, and gross profit reported assuming revenue is recognized over time using... 1. the number of employees trained as a measure of the value provided to the customer. Note: Round answers to the nearest dollar.

Answers

Answer:

Philbrick Company

Performance Obligation Fulfilled Over Time

Computation of the revenue, expense, and gross profit:

Year Number of Development Sales Gross

Employees /Training Cost Value Profit

2019 150 $ 55,000 $165,000 $110,000

2020 250 70,000 275,000 205,000

2021 100 20,000 110,000 90,000

Total 500 $145,000 $550,000 $405,000

Explanation:

a) Data and Calculations:

Contract price = $1,100 per employee

No. of employees to be trained = 500

Total contract value = $550,000 ($1,100 * 500)

Expected Development and Training Costs:

Year Number of Development

Employees /Training Cost

2019 150 $ 55,000

2020 250 70,000

2021 100 20,000

Total 500 $145,000

The following data pertain to the Oneida Restaurant Supply Company for the year just ended.

Budgeted sales revenue $205,000

Actual manufacturing overhead 336,000

Budgeted machine hours (based on practical capacity) 8,000

Budgeted direct-labor hours (based on practical capacity) 20,000

Budgeted direct-labor rate $14

Budgeted manufacturing overhead $364,000

Actual machine hours 11,000

Actual direct-labor hours 18,000

Actual direct-labor rate $15

Required:

a. Compute the firm's predetermined overhead rate for the year using each of the following common cost drivers: (a) machine hours, (b) direct-labor hours, and (c) direct-labor dollars.

b. Calculate the over-applied or under-applied overhead for the year using each of the cost drivers listed above.

Answers

Answer:

Predetermined overhead rate = Budgeted manufacturing rate/Allocation base

a. Machine hours

= 364,000 / 8,000

= $45.5

Predetermined overhead rate = $45.5

Direct-labor hours

= 364,000 / 20,000

= $18.2

Predetermined overhead rate = $18.2

Direct-labor dollars

Budgeted labor hours = 20,000 * $14 = $280,000

Predetermined overhead rate = 364,000 / $280,000 = $1.3

b. Machine hours

Manufacturing overhead applied = Actual machine hours * Predetermined overhead rate = $45.5 * 11,000 = $500,500

Over/Under applied overhead = 336,000 - 500,500

Over-applied overhead = $164,500

Direct-labor hours

Manufacturing overhead applied = Actual direct-labor hours * Predetermined overhead rate = $18.2 * 18,000 = $327,600

Over/Under applied overhead = 336,000 - 327,600

Under-applied overhead = $8400

Direct-labor dollars

Manufacturing overhead applied = Actual direct-labor hours * Actual direct-labor rate * Predetermined overhead rate

Manufacturing overhead applied = 18,000 * $15 * $1.3 = 351,000

Over/Under applied overhead = 336,000 - 351,000

Over-applied overhead = $15,000

we know that

Predetermined overhead rate = Budgeted manufacturing rate ÷ Allocation base

a. Machine hours

= 364,000 ÷8,000

= $45.5

Predetermined overhead rate = $45.5

Direct-labor hours

= 364,000 ÷ 20,000

= $18.2

Predetermined overhead rate = $18.2

Direct-labor dollars

Budgeted labor hours = 20,000 × $14 = $280,000

Predetermined overhead rate = 364,000 ÷ $280,000 = $1.3

b. Machine hours

Manufacturing overhead applied = Actual machine hours × Predetermined overhead rate

= $45.5 × 11,000

= $500,500

So,

Over/Under applied overhead = 336,000 - 500,500

Over-applied overhead = $164,500

Direct-labor hours

Manufacturing overhead applied = Actual direct-labor hours × Predetermined overhead rate

= $18.2 × 18,000

= $327,600

Over/Under applied overhead = 336,000 - 327,600

Under-applied overhead = $8400

Direct-labor dollars

Manufacturing overhead applied = Actual direct-labor hours × Actual direct-labor rate × Predetermined overhead rate

= 18,000 × $15 × $1.3

= 351,000

Over/Under applied overhead = 336,000 - 351,000

Over-applied overhead = $15,000

Learn more: https://brainly.com/question/994316?referrer=searchResults

Suppose that, in a competitive market without government regulations, the equilibrium price of milk is $2.50 per gallon, and employees at grocery stores earn $21.50 per hour. Indicate the following whether each of the statements is an example of a price ceiling or a price floor and whether it results in a shortage or a surplus or has no effect on the price and quantity that prevail in the market.

a. There are many teenagers who would like to work at grocery stores, but the minimum-wage law sets the hourly wage at $25.00.

b. The government has instituted a legal minimum price of $2.30 per gallon for milk.

c. The government prohibits grocery stores from selling milk for more than $2.30 per gallon.

Answers

Explanation:

at price ceiling we have price set at a maximum level. it cannot be raised beyond this level. At binding price ceiling, price would be set to be lower than what is the equilibrium price level. a non binding price ceiling is set to be higher than equilibrium level.

At price floor, price is set to a particular minimum level. It cannot fall lower than this. At binding price floor, price is higher than equilibrium price' at non binding price floor, it is set to be lower than equilibrium price level.

this expalnation should help us to answer this question.

(a) Many teenagers would like to work but minimum wage is set at 25.00 we have Price floor, Binding

(b) Government instituted legal minimum price of a gallon of milk at $2.30 we have Price floor, Non-binding

(c) if the Government prohibits from selling milk for more than $2.30 per gallon then we have Price ceiling, Binding

Etxuck327 Inc. sells a particular textbook for $39. Variable expenses are $28 per book. At the current volume of 49,000 books sold per year the company is just breaking even. Given these data, the annual fixed expenses associated with the textbook total:

Answers

Answer:

539,000.00

Explanation:

As per the contribution margin analysis concept, the break-even point is obtained by dividing fixed cost by contribution margin per unit.

For Etuck327,

The selling price is $39

Variable expense is $28

Break-even in units is 49,000 books.

Contribution margin per unit = selling price - variable costs

=$39- $28

=$11

if Break-even = fixed cost/ contribution margin per unit, then

49,000= fixed cost / 11

fixed costs = 11 x 49000

Fixed costs = 539,000.00

The following information relates to Sheridan Company for the year 2022.

Retained earnings, January 1, 2022 $40,320

Advertising expense $1,510

Dividends during 2022 4,200

Rent expense 8,740

Service revenue 52,500

Utilities expense 2,600

Salaries and wages expense 23,520

Other comprehensive income (net of tax) 340

Required:

a. After analyzing the data, compute net income.

b. Prepare a comprehensive income statement for the year ending December 31, 2022.

Answers

Answer:

a. Computation of net income

Particulars Amount

Service revenue $52,500

Less: Expenses

Salaries and wages expenses ($23,520)

Utilities expense ($2,600)

Rent expense ($8,740)

Advertising expense ($1,510)

Net Income $16,130

b. Computation of comprehensive income statement

Particulars Amount

Net Income $16,130

Add: Other Comprehensive Income $380

Comprehensive Income $16,470

Note: Dividend will not be included as it forms part of Income statement

DS Unlimited has the following transactions during August.

August 6 Purchases 52 handheld game devices on account from GameGirl, Inc.,

for $110 each, terms 2/10, n/60.

August 7 Pays $310 to Sure Shipping for freight charges associated with the

August 6 purchase.

August 10 Returns to GameGirl seven game devices that were defective.

August 14 Pays the full amount due to GameGirl.

August 23 Sells 32 game devices purchased on August 6 for $130 each to

customers on account. The total cost of the 32 game devices sold is

$3,670.00.

Required:

Record the transactions of DS Unlimited, assuming the company uses a perpetual inventory system.

Answers

Answer:

Date Account Title Debit Credit

Aug-06 Inventory $5,720

(52 * $110)

Accounts Payable $5,720

Aug-07 Inventory $310

Cash $310

Aug-10 Accounts Payable $770

(7 * $110 )

Inventory $770

Aug-14 Accounts Payable $4,950

Inventory $99

Cash $4,851

Aug-23 Accounts Receivable $4,160

( 32*$130)

Sales revenue $4,160

Aug-23 Cost of goods sold $3,670

Inventory $ 3,670

Composing powerful paragraphs is essential when striving for clear communication. Familiarize yourself with basic paragraph elements, various paragraph patterns, and strategies for building coherence.

Use the following paragraphs to answer the questions that follow.

Paragraph A: Last week, three of our Xcite executives closed a lucrative merger deal with Editionplus. The merger will add more than 500 accounts to our business and will increase our profits by 39 percent in less than a year. Additionally, the executives met with several Editionplus product designers and agreed on three new computer prototypes that we will produce during the next five years. This means we will expand our business to both Los Angeles and Las Vegas.

Paragraph B: Employee reaction has been mixed about our recent plans to expand to Las Vegas and Los Angeles. Many Xcite employees are concerned that the Los Angeles site will not have the same relaxed corporate environment as the current site. However, this is not the case: The relaxed corporate environment at the San Francisco site will be replicated in Los Angeles. The culture we have developed works for the company and our employees, and we don't plan to change it. Human resources executives are already interviewing San Francisco employees so they can capture and replicate the culture with ease.

Paragraph C: The leadership at the Xcite San Francisco site has been phenomenal during the last ten years. Everyone in senior-level positions has worked his or her way up the corporate ladder and has contributed greatly to the company's success. This team has increased our profits by 6 percent, expanded office space, hired additional IT support, and strengthened our IT infrastructure. These are just a few of this leadership team's many accomplishments. In the next two months, a new leadership team will be formed for the Los Angeles site. This team will consist of transferred employees from the San Francisco site. We will be offering many of you a chance to be part of this move. Additional training will be required for all who are transferring, and moving costs will not be covered. Xcite looks forward to opening another location with excellent products, high profits, and 100 percent employee and customer satisfaction.

Required:

1. Which paragraph or paragraphs use the pivoting approach?

a. A, C

b. B

c. A

2. What is the main idea of Paragraph A?

Answers

Answer:

1. Which paragraph or paragraphs use the pivoting approach?

b. BPivoting writing uses the words even though, however, but, in spite off, etc., to pivot back to the main idea of the paragraph. In paragraph B, it starts talking about employee concerns about a bad corporate environment in the new offices (in Los Angeles or Las Vegas), and then it assures that this will not happen. It affirms that the company is taking care of the issue and the corporate environment in LA will be the same as in San Francisco.

2. What is the main idea of Paragraph A?

If informs the reader that the company just closed a merger with Editionplus and that soon profits should increase, new products will developed and the company will grow.

If there is a technological advance that lowers the cost of producing x-ray machines, then we can say that the

Answers

Answer:

C) quantity supplied of those machines will go up.

Explanation:

the options are missing:

A ) quantity demanded for those machines will increase.

B) demand for those machines will shift right.

C) quantity supplied of those machines will go up.

D) quantity supplied of those machines will decrease.

If production costs decrease, the supply curve will shift to the right, increasing the total quantity supplied while decreasing the sales price. Advances in technology increase productivity, which allows companies to supply a higher amount of goods at lower prices, which in turn increases the total quantity demanded for these goods.

Jane is planning to go on a camping trip. She purchases a bottle of mineral water, a pack of biscuits, a small tube of toothpaste, and a toothbrush from the supermarket near her house. The items that Jane has purchased from the supermarket are _____.

Answers

franchise

Explanation:

right granted to an individual or group to the market for a business goods or services within a certain area

Jane is planning to go on a camping trip. The items that Jane has purchased from the supermarket are non durable goods.

What do you mean by the non durable goods?The lifespan of consumer nondurable items, which are bought for immediate or nearly immediate consumption, ranges from minutes to three years. These frequently include things like meals, drinks, clothes, shoes, and gasoline.

Non-durable commodities are typically produced, delivered, and sold to consumers quickly.

These products are frequently used very rapidly as well, thus consumers require a constant supply in order to keep stocking up.

Therefore, Jane is planning to go on a camping trip. She purchases a bottle of mineral water, a pack of biscuits, a small tube of toothpaste, and a toothbrush from the supermarket near her house. The items that Jane has purchased from the supermarket are non durable goods.

To know more about the non durable goods, visit:

https://brainly.com/question/28606276

#SPJ2

On May 31, the Cash account of Teasel had a normal balance of $5,700. During May, the account was debited for a total of $12,900 and credited for a total of $12,200. What was the balance in the Cash account at the beginning of May

Answers

Answer:

$6,400

Explanation:

Cash Account

Debit :

Beginning Balance $5,700

Receipts $12,900

Totals $18,600

Credit :

Payments $12,200

Ending Balance (Balancing figure) $6,400

Totals $18,600

Help me please thank you

Answers

Answer:

You have to be intelligent, risk taking and you haver to care about your people.

Explanation:

Tom and Betsy, who are married filing jointly, reported a standard deduction of $24,000 on their 2018 tax return. They paid $500 to the state for income taxes in 2018. In 2019, they received a $125 refund of state taxes paid in 2018. What is the amount that Tom and Betsy need to report on their 2019 tax return?

Answers

Answer:

$0

Explanation:

Since Tom and Betsy didn't itemize their deductions in 2018 (they chose the standard deduction), they didn't include the state taxes in their tax filing. Since the state taxes were not used by Tom and Betsy to reduce their federal income taxes, then any refund will not be included in their current income. Only if state taxes are used to lower federal taxes, do taxpayers need to include any refund.

1. Stockholders invest $90,000 cash to start the business.

2. Purchased three digital copy machines for $400,000, paying $118,000 cash and signing a 5-year, 6% note for the remainder.

3. Purchased $5,500 paper supplies on credit.

4. Cash received for photocopy services amounted to $8,400.

5. Paid $500 cash for radio advertising.

6. Paid $800 on account for paper supplies purchased in transaction 3.

7. Dividends of $1,600 were paid to stockholders.

8. Paid $1,200 cash for rent for the current month.

9. Received $2,200 cash advance from a customer for future copying.

10. Billed a customer for $500 for photocopy services completed.

No. Account Titles and Descriptions Debit Credit

1.

2.

3.

4.

5.

Answers

Answer:

1. Stockholders invest $90,000 cash to start the business.

Dr Cash 90,000

Cr Common stock 90,000

2. Purchased three digital copy machines for $400,000, paying $118,000 cash and signing a 5-year, 6% note for the remainder.

Dr Copy machines 400,000

Cr Cash 118,000*

Cr Notes payable 282,000

*Where did they get the extra cash from?

3. Purchased $5,500 paper supplies on credit.

Dr Supplies 5,500

Cr Accounts payable 5,500

4. Cash received for photocopy services amounted to $8,400.

Dr Cash 8,400

Cr Service revenue 8,400

5. Paid $500 cash for radio advertising.

Dr Advertising expense 500

Cr Cash 500

6. Paid $800 on account for paper supplies purchased in transaction 3.

Dr Accounts payable 800

Cr Cash 800

7. Dividends of $1,600 were paid to stockholders.

Dr Dividends 1,600

Cr Cash 1,600

8. Paid $1,200 cash for rent for the current month.

Dr Rent expense 1,200

Cr Cash 1,200

9. Received $2,200 cash advance from a customer for future copying.

Dr Cash 2,200

Cr Unearned service revenue 2,200

10. Billed a customer for $500 for photocopy services completed.

Dr Accounts receivable 500

Cr Service revenue 500

A company has net working capital of $1,996. If all its current assets were liquidated, the company would receive $5,923. What are the company's current liabilities?

Answers

Answer:Current Liabilities= $3,927

Explanation:

Net working capital= Current assets-current liabilities

Current Liabilities = Current assets - Net working capital

= $5,923- $1,996

=$3,927

Current liabilities are short term liabilities , debt or obligation of a business which should be due within one year so as to be paid to creditors.

The following were selected from among the transactions completed by Babcock Company during November of the current year:

Nov. 3 Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/30.

Nov.4 Sold merchandise for cash, $37,680. The cost of the merchandise sold was $22,600.

Nov. 5 Purchased merchandise on account from Papoose Creek Co., $47,500, terms FOB shipping point, 2/10, n/30, with prepaid freight of $810 added to the invoice.

Nov. 6 Returned $13,500 ($18,000 list price less trade discount of 25%) of merchandise purchased on November 3 from Moonlight Co.

Nov. 8 Sold merchandise on account to Quinn Co., $15,600 with terms n/15. The cost of the merchandise sold was $9,400.

Nov. 13 Paid Moonlight Co. on account for purchase of November 3, less return of November 6.

Nov. 14 Sold merchandise on VISA, $236,000. The cost of the merchandise sold was $140,000.

Nov. 15 Paid Papoose Creek Co. on account for purchase of November 5.

Nov. 23 Received cash on account from sale of November 8 to Quinn Co.

Nov. 24 Sold merchandise on account to Rabel Co., $56,900, terms 1/10, n/30. The cost of the merchandise sold was $34,000.

Nov. 28 Paid VISA service fee of $3,540.

Nov. 30 Paid Quinn Co. a cash refund of $6,000 for returned merchandise from sale of November 8. The cost of the returned merchandise was $3,300.

Journalize the transactions.

Answers

Answer:

Babcock Company

Journal Entries:

Nov. 3:

Debit Inventory $63,750

Credit Accounts Payable (Moonlight Co.) $63,750

To record the purchase of goods on account, terms FOB destination, 2/10, n/30.

Nov. 4:

Debit Cash Account $37,680

Credit Sales Revenue $37,680

To record the sale of goods for cash.

Debit Cost of goods sold $22,600

Credit Inventory $22,600

To record the cost of goods sold.

Nov. 5:

Debit Inventory $47,500

Credit Cash (For prepaid freight) $810

Credit Accounts Payable (Papoose Creek Co.) $46,690

To record the purchase of goods on account, terms FOB Shipping point, 2/10, n.30.

Nov. 6:

Debit Accounts Payable (Moonlight Co.) $13,500

Credit Inventory $13,500

To record the return of goods to Moonlight Co.

Nov. 8:

Debit Accounts Receivable (Quinn Co.) $15,600

Credit Sales Revenue $15,600

To record the sale of goods on account, terms n/15.

Debit Cost of goods sold $9,400

Credit Inventory $9,400

To record the cost of goods sold.

Nov. 13:

Debit Accounts Payable (Moonlight Co.) $50,250

Credit Cash Discount $1,005

Credit Cash Account $49,245

To record the payment for goods on account

Nov. 14:

Debit VISA Account $236,000

Credit Sales Revenue $236,000

To record the sale of goods on VISA.

Debit Cost of goods sold $140,000

Credit Inventory $140,000

To record the cost of goods sold.

Nov. 15:

Debit Accounts Payable (Papoose Creek Co.) $46,690

Credit Cash Discount $9,338

Credit Cash Account $37,353

To record the payment on account.

Nov. 23:

Debit Cash Account $15,600

Credit Accounts Receivable (Quinn Co.) $15,600

To record the receipt of cash on account.

Nov. 24:

Debit Accounts Receivable (Rable Co.) $56,900

Credit Sales Revenue $56,900

To record the sale of goods on account, terms 1/10, n/30.

Debit Cost of goods sold $34,000

Credit Inventory $34,000

To record the cost of goods sold.

Nov. 28:

Debit VISA Service Fee Expense $3,540

Credit Cash Account $3,540

To record the payment for VISA service.

Nov. 30:

Debit Inventory $3,300

Credit Cost of goods sold $3,300

To record the return of goods.

Debit Sales Returns $6,000

Credit Accounts Receivable $6,000

To record the return of goods by Quinn Co.

Debit Accounts Receivable $6,000

Credit Cash Account $6,000

To record the refund for returned goods.

Explanation:

Babcock Company uses Journals to record business transactions as they occur on a daily basis. They provide the needed guidance to ensure that the accounts involved in every business transaction are properly identified and entries are correctly recorded on the correct side of the accounts. Transactions are recorded following the ubiquitous accounting equation, the accrual concept, and matching principle of generally accepted accounting principles.

All of the current year's entries for Zimmerman Company have been made, except the following adjusting entries. The company's annual accounting year ends on December 31

On September 1 of the current year, Zimmerman collected six months' rent of $8,520 on storage space. At that date, Zimmerman debited Cash and credited Unearned Rent Revenue for $8,520.

On October 1 of the current year, the company borrowed $13,200 from a local bank and signed a one-year, 12 percent note for that amount. The principal and interest are payable on the maturity date.

Depreciation of $3,000 must be recognized on a service truck purchased in July of the current year at a cost of $24,000.

Cash of $3,600 was collected on November of the current year, for services to be rendered evenly over the next year beginning on November 1 of the current year. Unearned Service Revenue was credited when the cash was received.

On November 1 of the current year, Zimmerman paid a one-year premium for property insurance, $9,960, for coverage starting on that date. Cash was credited and Prepaid Insurance was debited for this amount.

The company earned service revenue of $4,200 on a special job that was completed December 29 of the current year. Collection will be made during January of the next year. No entry has been recorded.

At December 31 of the current year, wages earned by employees totaled $13,700. The employees will be paid on the next payroll date in January of the next year.

On December 31 of the current year, the company estimated it owed $490 for this year's property taxes on land. The tax will be paid when the bill is received in January of next year.

2. Using the following headings, indicate the effect of each adjusting entry and the amount of the effect. Use + for increase, − for decrease. (Reminder: Assets = Liabilities + Stockholders’ Equity; Revenues – Expenses = Net Income; and Net Income accounts are closed to Retained Earnings, a part of Stockholders’ Equity.)

Answers

Answer:

1) adjusting entries

a. On September 1 of the current year, Zimmerman collected six months' rent of $8,520 on storage space. At that date, Zimmerman debited Cash and credited Unearned Rent Revenue for $8,520.

Dr Unearned rental revenue 5,500

Cr Rental revenue 5,500

b. On October 1 of the current year, the company borrowed $13,200 from a local bank and signed a one-year, 12 percent note for that amount. The principal and interest are payable on the maturity date.

Dr Interest expense 396

Cr Interest payable 396

c. Depreciation of $3,000 must be recognized on a service truck purchased in July of the current year at a cost of $24,000.

Dr Depreciation expense 3,000

Cr Accumulated depreciation 3,000

d. Cash of $3,600 was collected on November of the current year, for services to be rendered evenly over the next year beginning on November 1 of the current year. Unearned Service Revenue was credited when the cash was received.

Dr Unearned service revenue 600

Cr Service revenue 600

e. On November 1 of the current year, Zimmerman paid a one-year premium for property insurance, $9,960, for coverage starting on that date. Cash was credited and Prepaid Insurance was debited for this amount.

Dr Insurance expense 1,660

Cr Prepaid insurance 1,660

f. The company earned service revenue of $4,200 on a special job that was completed December 29 of the current year. Collection will be made during January of the next year. No entry has been recorded.

Dr Accounts receivable 4,200

Cr Service revenue 4,200

g. At December 31 of the current year, wages earned by employees totaled $13,700. The employees will be paid on the next payroll date in January of the next year.

Dr Wages expense 13,700

Cr Wages payable 13,700

h. On December 31 of the current year, the company estimated it owed $490 for this year's property taxes on land. The tax will be paid when the bill is received in January of next year.

Dr Property taxes expense 490

Cr Property taxes payable 490

2) Assets = Liabilities + Stockholders’ Revenues - Expenses = Net

Equity Income

a. na - + + na +

b. na - - na - -

c. - na - na - -

d. na - + + na +

e. - na - na - -

f. + na + + na +

g. na + - na - -

h. na + - na - -

At Davide Corporation, direct materials are added at the beginning of the process and conversions costs are uniformly applied. Other details include:

WIP beginning (60% for conversion) 17,500 units

Units started 114,500 units

Units completed and transferred out 111,700 units

WIP ending (30% for conversion) 20,300 units

Beginning WIP direct materials $22,300

Beginning WIP conversion costs $19,700

Costs of materials added $370,000

Costs of conversion added $280,000

What is the total cost of units completed and transferred out?

Answers

Answer and Explanation:

For materials

Equivalent completed units = Completed units + WIP ending

= 111,700 + 20,300

= 132,000 units

Cost of materials = Beginning WIP + Cost of materials added

= 22,300 + 370,000

= $392,300

Cost of material per units = 392,300 ÷ 132,000

= $2.97197

For conversions

Equivalent completed units = Completed units + WIP ending

= 111,700 + 20,300 × 30%

= 117,790 units

Cost of Conversion = Beginning WIP + Cost of conversion added

= 19,700 + 280,000

= $299,700

Cost of conversion per units = 299,700 ÷ 117,790

= $2.54436

Total cost of units completed and transferred out

= 111,700 × (2.97197 + 2.54436)

= $616,174

Determining the true cash balance, starting with the unadjusted book balance

Nickleson Company had an unadjusted cash balance of $7,176 as of May 31. The company’s bank statement, also dated May 31, included a $67 NSF check written by one of Nickleson’s customers. There were $1,239 in outstanding checks and $255 in deposits in transit as of May 31. According to the bank statement, service charges were $35, and the bank collected an $600 note receivable for Nickleson. The bank statement also showed $14 of interest revenue earned by Nickleson.

Required:

Determine the true cash balance as of May 31. (Hint: It is not necessary to use all of the preceding items to determine the true balance.)

True cash balance

Answers

Answer:

True Cash Balance $7,688

Explanation:

The computation of the true cash balance is shown below:

Unadjusted Cash Balance as of May 31 $7,176

Add: Interest Earned $14

Note Collected by Bank $600

Less: NSF check ($67)

Less Bank charges ($35)

True Cash Balance $7,688

Hence, the true cash balance is $7,688 and the same is to be considered

You have just been hired as a financial analyst for Barrington Industries. Unfortunately, company headquarters (where all of the firm's records are kept) has been destroyed by fire. So, your first job will be to recreate the firm's cash flow statement for the year just ended. The firm had $100,000 in the bank at the end of the prior year, and its working capital accounts except cash remained constant during the year. It earned $5 million in net income during the year but paid $750,000 in dividends to common shareholders. Throughout the year, the firm purchased $5.4 million of machinery that was needed for a new project. You have just spoken to the firm's accountants and learned that annual depreciation expense for the year is $450,000; however, the purchase price for the machinery represents additions to property, plant, and equipment before depreciation. Finally, you have determined that the only financing done by the firm was to issue long-term debt of $1 million at a 5% interest rate. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.

What was the firm's end-of-year cash balance? Recreate the firm's cash flow statement to arrive at your answer. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar, if necessary.

Answers

Answer:

200,000

Explanation:

A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. The cash flow statement measures how well a company manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses.

Cash flow from operating activities

Net Income 5,000,000

Less Depreciation (450,000)

Cashflow from operations 5,450,000

Cash flow from investing activities

Purchase of Fixed assets 5,400,,000

Cash flow from investing activities

Issue of long term debt 1,000,000

Dividend paid (750,000)

Cash generated from investing activities 250,000

Change in cash 300,000

Beginning balance 100,000

Closing balance 200,000

Seiko’s current salary is $85,000. Her marginal tax rate is 32 percent and she fancies European sports cars. She purchases a new auto each year. Seiko is currently a manager for an Idaho Office Supply. Her friend, knowing of her interest in sports cars, tells her about a manager position at the local BMW and Porsche dealer. The new position pays only $75,000 per year, but it allows employees to purchase one new car per year at a discount of $15,000. This discount qualifies as a nontaxable fringe benefit. In an effort to keep Seiko as an employee, Idaho Office Supply offers her a $10,000 raise. Answer the following questions about this analysis.

Problem 12-41

Part a a. Assuming it has a 21 percent marginal tax rate, what is the annual after-tax cost to Idaho Office Supply to provide Seiko with the $10,000 increase in salary?

Answers

Answer:

$7,900

Explanation:

Calculation for the annual after-tax cost

Additional salary = $ 10,000

Marginal tax rate=21%

First step is to find the income tax benefit

Income tax benefit = $ 10,000 x 21%

Income tax benefit= $ 2,100

Second step is to find the Annual after tax cost of additional salary

Annual after tax cost of additional salary = $ 10,000 - $2,100

Annual after tax cost of additional salary = $7,900

Therefore the annual after-tax cost will be $7,900

Robert G. Flanders Jr., the state-appointed receiver for Central Falls, RI, said his city's declaration of bankruptcy had proved invaluable in helping it cut costs. Before the city declared bankruptcy, he said, he had found it impossible to wring meaningful concessions out of the city's unions and retirees, who were being asked to give up roughly half of the pensions they had earned as the city ran out of cash.

True or False

Answers

Answer: false

Explanation:

The alternative to the term of agreement is the declaration of bankruptcy, in which the cities can extract their pensions, it gives a much better alternative. It also increases the bargaining powers of the members of the city. It will help in extracting concessions from the government. It also increases the disagreement value of the city.

What does patriotism mean

Answers

Answer:

patriotism is a synonym for Nationalism; a feeling of extreme pride for one's country.

Explanation:

Answer:

iiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiii

Explanation:

Swifty Company purchased equipment for $256,800 on October 1, 2020. It is estimated that the equipment will have a useful life of 8 years and a salvage value of $12,000. Estimated production is 48,000 units and estimated working hours are 20,400. During 2020, Swifty uses the equipment for 600 hours and the equipment produces 1,000 units.

Required:

Compute depreciation expense under each of the following methods. Swifty is on a calendar-year basis ending December 31.

a. Straight-line method for 2020 $enter a dollar amount.

b. Activity method (units of output) for 2020 $enter a dollar amount.

c. Activity method (working hours) for 2020 $enter a dollar amount.

d. Sum-of-the-years'-digits method for 2022 $enter a dollar amount (e) Double-declining-balance method for 2021

Answers

Answer:

a. Straight line method.

Depreciation per annum = ($ 256,800 - $12,000 ) / 8 = $ 30,600.

Depreciation for 2020 = $ 30,600 * ( 3 /12 ) = $ 7,650.

b. Units of output

Depreciation per unit = ( $ 256,800 - $ 12,000 ) / 48,000 = $ 5.1

Depreciation for 2020 = 1,000 * $ 5.1 = $ 5,100.

c. Working hours.

Depreciation per hours = ( $ 256,800 - $ 12,000 ) / 20,400 = $ 12

Depreciation for 2020 = 600 * $ 12 = $ 7,200.

D. Sum of digits method

Sum of years = 8 ( 8 +1 ) / 2 = 36.

Year - 1 used ( 3 / 12 = 0.25)

Year-2 used ( 12 / 12 = 1 )

Remaining ( 8 - 1 - 0.25 = 6.75)

Depreciation for 2022 = ($ 256,800 - $ 12,000 ) * ( 6.75 / 36 )

Depreciation for 2022 = $ 45,900.

e. Double declining balance

Depreciation rate = 200 / 8 = 25 %.

Depreciation for 2020 = $256,800 * 25 % * (3 /12)

Depreciation for 2020 = $16,050.

Depreciation for 2021 = ( $256,800 - $ 16,050) * 25%

Depreciation for 2021 = $60,188.

One-year Treasury securities yield 4.85%. The market anticipates that 1 year from now, 1-year Treasury securities will yield 5.2%. If the pure expectations theory is correct, what is the yield today for 2-year Treasury securities

Answers

Answer:

5.025%

Explanation:

When we assume that the pure expectations theory is correct, then we are assuming that there is no risk premium involved. The formula to determine the yield for the 2 year treasury security:

(1 + i)² = (1 + 4.85%) x (1 + 5.2%)

(1 + i)² = 1.0485 x 1.052

(1 + i)² = 1.103022

√(1 + i)² = √1.103022

1 + i = 1.050248542

i = 0.050248542 = 5.025%

The following incorrect income statement was prepared by the accountant of the Axel Corporation:

AXEL CORPORATION Income Statement For the Year Ended December 31, 2021 Revenues and gains:

Sales revenue $660,000

Interest revenue 39,000

Gain on sale of investments 86,000

Total revenues and gains 785,000

Expenses and losses:

Cost of goods sold $360,000

Selling expense 66,000

Administrative expense 86,000

Interest expense 23,000

Restructuring costs 62,000

Income tax expense 47,000

Total expenses and losses 644,000

Net Income $141,000

Earnings per share $1.41

Required:

Prepare a multiple-step income statement for 2018 applying generally accepted accounting principles. The income tax rate is 40%.

Answers

Answer:

AXEL CORPORATION

Income Statement For the Year Ended December 31, 2021

Particulars Amount Amount

Sales Revenue $6,60,000

Less : Cost of Goods Sold $360,000

Gross Profit $300,000

Less: Operating Expenses

Selling Expenses $66,000

Administrative Expenses $86,000 $152,000

Operating Income $148,000

Non- Operating and others

Restructuring cost -$62,000

Interest Expenses -$23,000

Interest Revenue $39,000

Gain on sale of investment $86,000 $40,000

Net Income before Taxes $188,000

Less : Income Tax Expenses $47,000

Net income after Taxes $141,000

The Earning Per Shares remains $1.41

Consider an economy that produces only chocolate bars. In year 1, the quantity produced is 3 bars and the price is $4. In year 2, the quantity produced is 4 bars and the price is $5. In year 3, the quantity produced is 5 bars and the price is $6. Using year 1 as the base year, compute nominal GDP, real GDP, and the GDP deflator for each year.

Answers

Answer:

The answer is below

Explanation:

The nominal GDP is the market value of goods within a country adjusted for price change.

Nominal GDP for year 1 = Total market value of goods at current price = 3 bars × $4 = $12

Nominal GDP for year 2 = Total market value of goods at current price = 4 bars × $5 = $20

Nominal GDP for year 3 = Total market value of goods at current price = 5 bars × $6 = $30

The real GDP is the market value of goods within a country at current price.

Real GDP for year 1 = Total market value of goods at base year price = 3 bars × $4 = $12

Real GDP for year 2 = Total market value of goods at base year price = 4 bars × $4 = $16

Real GDP for year 3 = Total market value of goods at base year price = 5 bars × $4 = $20

GDP deflator is the ratio of nominal GDP to real GDP multiplied by 100.

GDP deflator in year 1 = (Nominal GDP in year 1 / Real GDP in year 1) × 100 = ($12/$12) × 100 = 100

GDP deflator in year 2 = (Nominal GDP in year 2 / Real GDP in year 2) × 100 = ($20/$16) × 125 = 100

GDP deflator in year 3 = (Nominal GDP in year 3 / Real GDP in year 3) × 100 = ($30/$20) × 100 = 150

A remotely located air sampling station can be powered by solar cells or by running an electric line to the site and using conventional power. Solar cells will cost $12,600 to install and will have a useful life of 4 years with no salvage value. Annual costs for inspection, cleaning, etc. are expected to be $1,400. A new power line will cost $11,000 to install, with power costs expected to be $800 per year. Since the air sampling project will end in 4 years, the salvage value of the line is considered to be zero. At an interest rate of 10% per year, which alternative should be selected on the basis of a future worth analysis?

Answers

Answer:

Since the total future worth of running an electric line of $19,353.42 is less than the total future worth of solar cells is $24,132.22, it implies that it will be cheaper to run an electric line than to use solar cells. Therefore, running an electric line should be selected.

Explanation:

The future worth analysis refers to an act of determining what the the worth of present amount of money or stream of money invested at an interest rate will after in some period or years to come.

To determine which one to select between solar cells and running an electric line, the we need to calculate the future worth of both and compared as follows:

a. Calculation of future value of solar cells

Calculation of future worth of $12,600 installation cost

FW of $12,600 = PW of $12,600 * (1 + r)^n ................ (1)

Where;

FW of $12,600 = Future worth of $12,600 installation cost = ?

PW of $12,600 = Present worth of $12,600 installation cost = $12,600

r = interest rate = 10%, or 0.10

n = number of years = 4

Substitute the values into equation (1), we have:

FW of $12,600 = $12,600 * (1 + 0.10)^4

FW of $12,600 = $12,600 * 1.4641

FW of $12,600 = $18,447.66

Calculation of future worth of annual costs for inspection, cleaning, etc. of $1,400

The future worth of annual costs for inspection, cleaning, etc. of $1,400 can also be calculated using the formula for calculating the Future Value (FV) of an Ordinary Annuity as follows:

FW of $1,400 = M * (((1 + r)^n - 1) / r) ................................. (2)

Where,

FW of $1,400 = Future value of Annual costs for inspection, cleaning, etc. of $1,400 =?

M = Annual costs for inspection, cleaning, etc. = $1,400

r = interest rate = 10%, or 0.10

n = number of years = 4

Substitute the values into equation (2), we have:

FW of $1,400 = $1,400 * (((1 + 0.01)^4 - 1) / 0.01)

FW of $1,400 = $1,400 * 4.060401

FW of $1,400 = $5,684.56

Calculation of total future worth of solar cells

This is calculated by simply adding the FW of $12,600 and FW of $1,400 as follows:

Total future worth of solar cells = FW of $12,600 + FW of $1,400 = $18,447.66 + $5,684.56 = $24,132.22

Therefore, the total future worth of solar cells is $24,132.22.

b. Calculation of future value of running an electric line

Calculation of future worth of $11,000 installation cost

FW of $11,000 = PW of $11,000 * (1 + r)^n ................ (3)

Where;

FW of $11,000 = Future worth of $11,000 installation cost = ?

PW of $11,000 = Present worth of $11,000 installation cost = $11,000

r = interest rate = 10%, or 0.10

n = number of years = 4

Substitute the values into equation (3), we have:

FW of $11,000 = $11,000 * (1 + 0.10)^4

FW of $11,000 = $11,000 * 1.4641

FW of $11,000 = $16,105.10

Calculation of future worth of expected annual power costs of $800

The future worth of expected annual power costs of $800 can also be calculated using the formula for calculating the Future Value (FV) of an Ordinary Annuity as follows:

FW of $800 = M * (((1 + r)^n - 1) / r) ................................. (4)

Where,

FW of $800 = Future value of expected annual power costs of $800 =?

M = Expected annual power costs = $800

r = interest rate = 10%, or 0.10

n = number of years = 4

Substitute the values into equation (4), we have:

FW of $800 = $800 * (((1 + 0.01)^4 - 1) / 0.01)

FW of $800 = $800 * 4.060401

FW of $800 = $3,248.32

Calculation of total future worth of running an electric line

This is calculated by simply adding the FW of $11,000 and FW of $800 as follows:

Total future worth of running an electric line = FW of $11,000 + FW of $800 = $16,105.10 + $3,248.32 = $19,353.42

Therefore, the total future worth of running an electric line is $19,353.42.

c. Conclusion

Since the total future worth of running an electric line of $19,353.42 is less than the total future worth of solar cells is $24,132.22, it implies that it will be cheaper to run an electric line than to use solar cells. Therefore, running an electric line should be selected.

If a specific economy has extra capital resources available,

be able to produce top-quality goods and services.

continually look to expand and invest.

be able to produce more goods and services needed and wanted by society.

have additional labor available to focus on production.

this

Answers

Answer: A

Be able to produce top-quality goods and services

If a specific economy has extra capital resources available, be able to produce more goods and services needed and wanted by society.

What is an economy?An economy is a region where products and services are produced, distributed, traded, and consumed. It is generally understood to be a social domain that places an emphasis on the behaviors, discourses, and tangible manifestations connected to the creation, utilization, and management of finite resources.

One's culture, values, education, technological advancement, history, social organization, political structure, legal system, and natural resources are all major determinants of an economy's processes.

These elements determine the parameters and conditions under which an economy operates in addition to providing background and content. In other words, the economic realm is a social domain made up of connected human behaviors and exchanges that cannot exist independently.

Individuals, companies, organizations, or governments all qualify as economic actors. When two persons or organizations agree on the value or price of the good or service being exchanged, which is typically stated in a particular currency, an economic transaction takes place.

Learn more about economy, here

https://brainly.com/question/2421251

#SPJ6